In this Issue…

A Look Into the Markets

Mortgage Market Guide Candlestick Chart

Economic Calendar for the Week of September 27 – October 1

A Look Into the Markets

Home loan rates ticked up and had a bit of a “taper tantrum” after the Fed meeting on Wednesday when Fed Chair Powell outlined the case to scale back or “taper” bond purchases. Let’s break down what was said and what to look for in the weeks ahead.

“Asset purchases still have a use, but it is time to taper them.” – Fed Chair Jerome Powell…Sept 22, 2021

The Fed has been purchasing $120B worth of Treasuries and Mortgage-Backed Securities since March 2020 to stabilize the financial markets and help pin down long-term rates. This effort has helped fuel the frenzy in both purchase and mortgage refinance activity.

On Wednesday, during a press conference, Fed Chair Powell made it clear that the days of bond-buying are coming to an end and the scaling back of purchases may start before the end of the year. Here are some important quotes from the press conference:

“There is very broad support on committee for timing and pace of taper”

This is important as Fed Members are in alignment on the issue to taper, which means there is a good chance it is going to happen soon.

“There are some who would have preferred to go sooner due to financial stability concerns.”

This line highlights the fear that some Fed Members have of inflation/price instability that comes with too much money in the financial system.

“Wouldn’t put too much on inflation remaining above goal in Fed’s current outlook.”

However, Fed Chair Powell and most of the Fed believe the current high levels of inflation will be transitory or short-term in nature. The Fed forecasted Core inflation dropping down to 2.3% next year, which would be right in the Fed’s sweet spot. If inflation moderates to those levels, interest rates may not be pressured higher, which allows the Fed to scale back bond purchases.

“Completing taper sometime around the middle of next year will be appropriate.”

And for the first time, we have a timeline. The Fed is looking to scale back $120B a month in purchases to zero by mid-2022.

What’s next? Mark your calendar as the next Fed meeting is Wednesday, November 3rd…that is the day markets feel the Fed will announce the taper start if they want to complete the tapering by mid-2022.

For the Fed to make a taper announcement in November, we likely need to see more progress on the labor market, which means the September Jobs Report, being reported Friday, Oct 8th is a big deal. If that report is solid, expect the Fed to make the announcement. If the report stinks, as some have of late, the Fed may not announce the taper.

Other unknowns which might delay a taper announcement include the debt ceiling negotiation, infrastructure debate, and signs of Chinese property bubbles losing air.

Bottom line: Now we know the Fed wants to taper and it may come as soon as November. This means it is very difficult for rates to improve much if at all from here. So, if you or someone you know is considering a new mortgage, now is an incredible time.

Looking Ahead

We know the next Jobs Report on Oct 8th carries huge significance. But next week there is plenty of news that could gyrate the markets as we look for more signs that it is time to taper bond purchases which include Retail Sales, Consumer Confidence, and Core PCE. And if that were not enough, we have Fed Chair Powell and Treasury Secretary testifying in front of Congress on the state of the economy. Lastly, the Treasury is selling billions in 2, 5, and 7-Year Treasuries. It will be interesting to see investor’s buying appetite now we know the Fed is interested in not being a buyer very soon.

Mortgage Market Guide Candlestick Chart

Mortgage-Backed security (MBS) prices are what determine home loan rates. The chart below is the Fannie Mae 30-year 2% coupon, where currently closed loans are being packaged. As prices go higher, rates move lower and vice versa.

After falling beneath multiple floors of support, like the 100-day MA (Orange line) and $101…the path of least resistance appears lower in price and higher in rate. Couple this with the Fed looking to stop buying bonds and you have a recipe for volatility and higher rates ahead.

Chart: Fannie Mae 30-Year 2% Coupon (Friday, September 24, 2021)

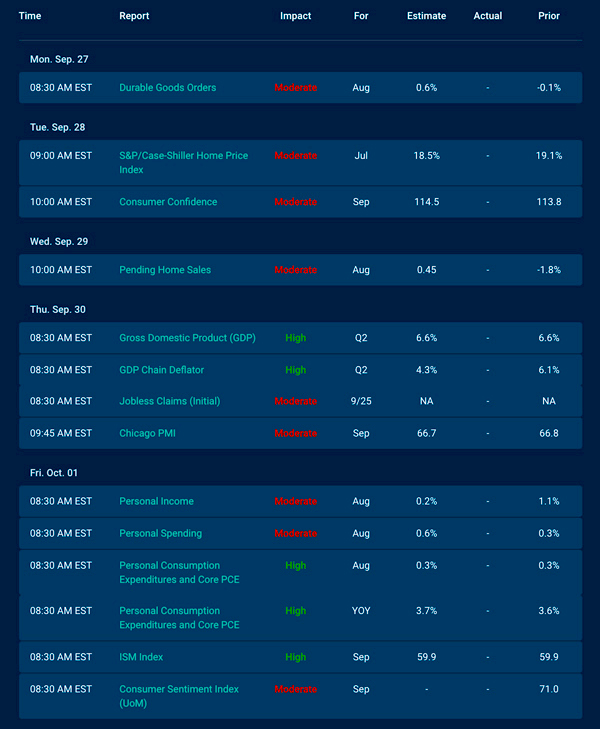

Economic Calendar for the Week of September 27 – October 1

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services, and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors. As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you. Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features, or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.

We are ready to help you find the best possible mortgage solution for your situation. Contact Sheila Siegel at Synergy Financial Group today.