In this Issue…

A Look Into the Markets

Mortgage Market Guide Candlestick Chart

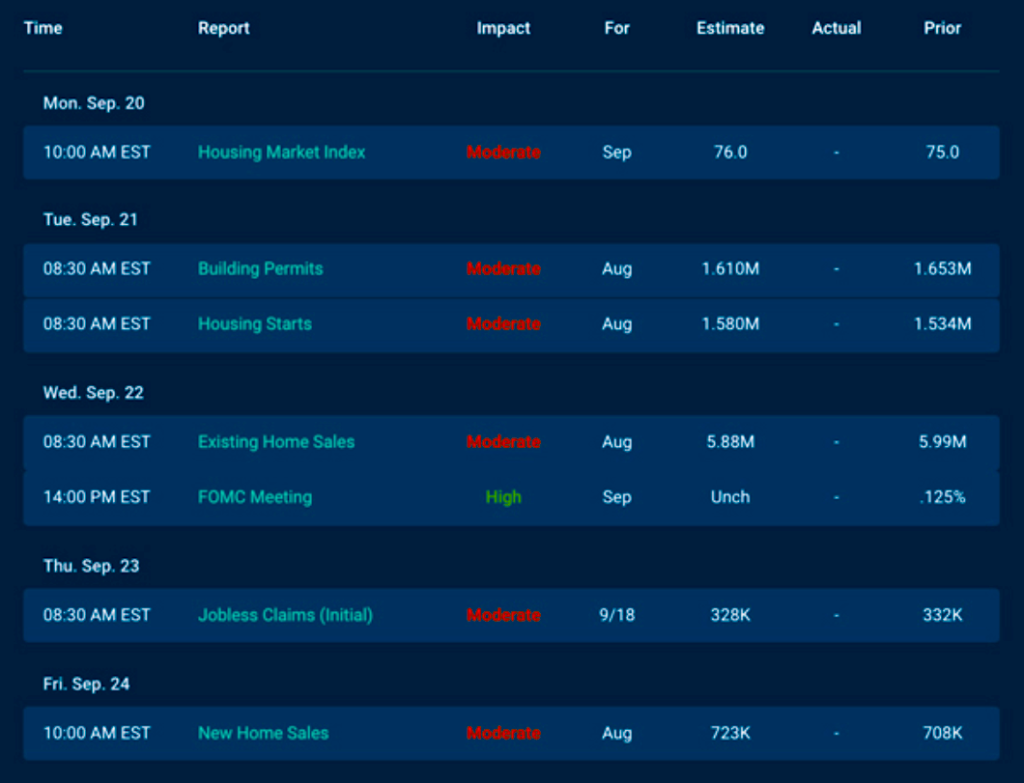

Economic Calendar for the Week of September 20 – September 25

A Look Into the Markets

Home loan rates were mainly unchanged this past week. Let’s break down what is threatening the financial markets and rates. And let’s revisit the pending technical breakout in mortgage rates in the chart section below.

The Taper Threat

A big threat to stocks, bonds, and rates is when the Fed will announce a tapering or scaling back of bond purchases. Presently the Fed has been buying at least $120B worth of Treasuries and mortgage-backed securities (MBSs) every month. This Fed buying is the main reason why home loan rates remain near all-time lows.

With inflation elevated and froth in the housing market, there is growing pressure on the Fed to start buying fewer bonds – and there is speculation the Fed will start tapering by purchasing fewer MBSs.

No one knows what, if and when the Fed will do anything, but if the Fed buys fewer MBSs, home loan rates will likely move higher. Back in 2013, when the Fed mentioned the word “taper” home loan rates shot up 2.5% over the next 6 months. The Fed knows this and is trying to scale back purchases without causing a similar disruption.

The next Fed Meeting Monetary Policy Statement will be released on Wednesday, Sept 22nd at 2:00 p.m. ET. We will find out soon enough if the Fed is confident enough to scale back bond purchases and not trigger a taper tantrum reaction in the bond market as we saw back in 2013.

The Tax Threat

The Administration and Congress are trying to pass a $3.5T spending plan that will include various tax hikes. There is a concern in the financial markets that a broad range of tax hikes could lead to slower economic growth, at a time when economic growth is already decelerating. Stocks don’t like the idea of slower growth and have been under selling pressure of late as details of the $3.5T plan have emerged.

Normally bonds and rates would do well when stocks suffer. But that has not happened this past week. Bonds are worried about the taper threat and the idea that a large $3.5T plan could put upward pressure on rates as the bond market has to absorb all the new bond issuance required to fund the enormous spending plan.

Much like the taper threat, no one knows how big the spending plan will ultimately be and what taxes will be included. Once something is close to being passed, stocks, bonds, and rates will react accordingly.

Bottom line: We do not know if the Fed will also announce a “modest” tapering in bond purchases next week or how the bond market will react. At some point, the Fed will have to scale back purchases and when it does, we should expect an increase in rates. If you or someone you know is considering a new mortgage, now is an incredible time.

Looking Ahead

There are some housing reports and other economic readings which would normally move the markets, but they all take a back seat to Wednesday’s Fed meeting. On Sept 22nd at 2 pm, the Fed will deliver their Monetary Policy Statement. This will be a big event.

Mortgage Market Guide Candlestick Chart

Mortgage-backed securities (MBS) prices are what determine home loan rates. The chart below is the Fannie Mae 30-year 2% coupon, where currently closed loans are being packaged. As prices go higher, rates move lower and vice versa.

A technical breakout is coming. The 100-day Moving Average (the Orange Line) has kept MBS prices from falling and home loan rates moving higher. The 200-day Moving Average (the Purple Line) has kept a lid on price advances and prevented rates from further improvement. MBSs are going to break out of this range soon and when they do, we could likely see an extended move in either direction. This week’s Fed meeting may be the catalyst for this breakout.

Chart: Fannie Mae 30-Year 2% Coupon (Friday, September 17, 2021)

Economic Calendar for the Week of September 20 – 24

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services, and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors. As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you. Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features, or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.

We are ready to help you find the best possible mortgage solution for your situation. Contact Sheila Siegel at Synergy Financial Group today.