Labor Day History

At the height of the Industrial Revolution in the late 1800s, the average American worker put in long hours and seven-day weeks under less than desired working conditions. Children, well under today’s working age, worked in mills and factories. Out of this came the notion of a “working man’s holiday” with many states passing legislation to recognize it. From there, it took off across the U.S. to become “Labor Day.”

Labor Day honors working people in the U.S. and is celebrated on the first Monday in September. It became a legal holiday in the District of Columbia, the territories and was signed into law on June 28th 1894, by then-President Grover Cleveland. Labor Day, the unofficial end of Summer, is celebrated across the United States with parades, picnics, barbecues, fireworks displays and other public gatherings. Enjoy this longstanding holiday with family, friends and fellow working Americans.

Looking Ahead

We will be watching labor market readings in the weeks and months ahead. Should we see “substantial further progress” towards the Feds mandate of maximum employment, the Fed may be forced to start tapering their bond purchases, which means home loan rates could be pressured a bit higher. The next Fed Meeting is September 21-22 and it will grab the financial markets attention.

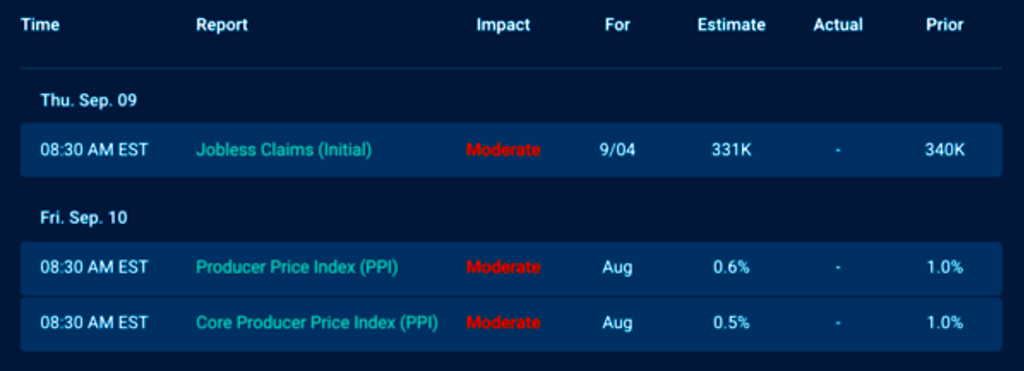

Next week’s economic calendar is extremely light on reports. However, there is an inflation reading by way of Producer Price Index, which could move the markets.

The economic calendar is extremely light for the holiday shortened week as the markets look to the September 21-22 FOMC meeting in the coming weeks.

Economic Calendar for the Week of September 6 – 10

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services, and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors. As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you. Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features, or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.

We are ready to help you find the best possible mortgage solution for your situation. Contact Sheila Siegel at Synergy Financial Group today.