In this Issue…

A Look Into the Markets

Mortgage Market Guide Candlestick Chart

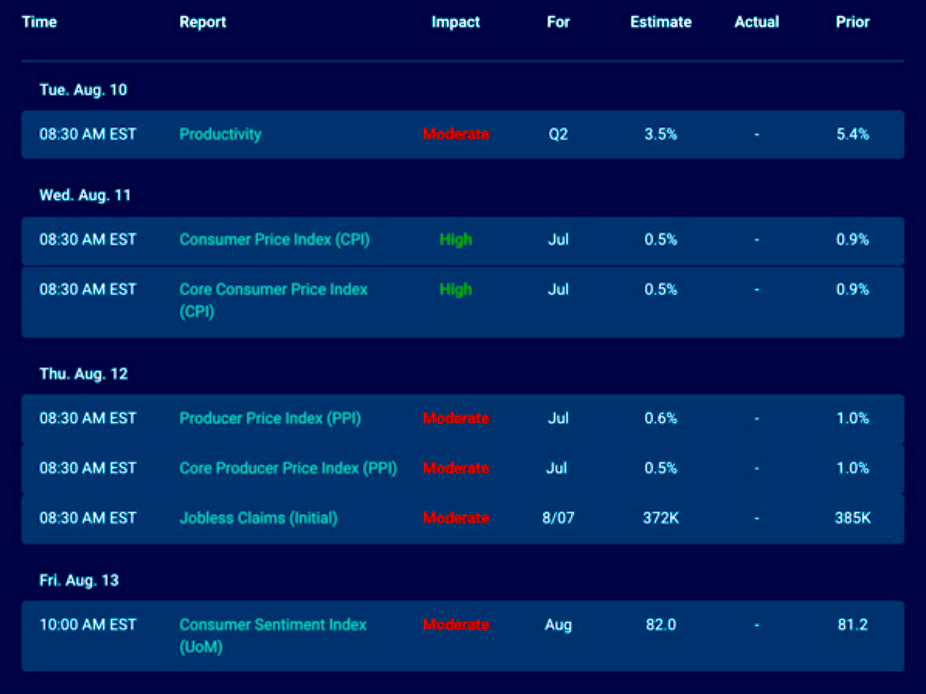

Economic Calendar for the Week of August 9 – August 13

A Look Into the Markets

“In a New York minute, everything can change” … New York Minute by Don Henley

This past week long-term interest rates dropped to the lowest levels in six months but things changed in a “New York Minute”. Let’s break down three things that moved the markets and what to look for in the week ahead.

1: “The path of the economy depends on the course of the virus.” – Fed Statement.

COVID continues to linger causing disruption and restrictions in economic activity. The stall in vaccinations and uncertainty surrounding the Delta and Delta Plus variant has been enough to cause investors to flee into the safe-haven of the U.S. Dollar and U.S. Dollar-denominated assets like Treasury and Mortgage-backed securities (MBS). Note, the 10-year Note yield has been seeing outsized rate improvement versus mortgage rates…this as the safe-haven trade typically sees more money flow into Treasuries than any other asset. So, while mortgage rates did improve week over week, they did not improve like the 10-year yield, which dropped sharply to 1.12% midweek.

2: Mixed signals on half the Fed’s mandate.

The Fed has a dual mandate to promote maximum employment and maintain price stability. On the employment front, the US economy is under-performing and receiving mixed signals. The recent Weekly Initial Jobless Claims data, a leading indicator on labor market health, has shown increases in those looking for unemployment benefits – this was not good. Wednesday’s ADP Report came in at half of expectations, suggesting private companies didn’t create that many jobs. However, the July Jobs Report showed 943,000 jobs created – which was a strong headline number. Lastly, looking under the hood of the report, the Labor Force Participation Rate didn’t move and remains stubbornly low – meaning there are less people “participating” in the labor force. If less people are working or actively looking for a job, that is a bad thing.

What does this mean? Until the Fed sees “substantial further progress towards its dual mandate,” including maximum employment, the Fed will continue to buy bonds at the current $120B per month rate. The strong headline Jobs Report will reinvigorate the bond taper talk, which will increase volatility in the weeks and months ahead. For homeowners, it also means now is the time, while the Fed continues to artificially hold rates lower.

3: The U.S. is the place to be.

The U.S. is outperforming the rest of the globe from an economic standpoint, and we are also seeing the largest policy response from the Fed and Administration which attracts global investment into U.S. markets. Additionally, while our 10-year Note is yielding an anemic 1.19% as of Thursday, it is a relatively “juicy” yield when compared to the 10-year German Bund, which is -0.50% or the Japan 10-year Government Bond (JGB) which yields 0.0%.

So, even though our 10-year Note yield may look like a bad investment because the yield is far beneath the long-term inflation rate, it is far better than any other bond yield around the globe. This dynamic pushes foreign investors to “park” their money in our Treasury market – leading to lower rates.

Bottom line: Interest rates are at the best levels seen since mid-February, making it a great opportunity to secure a home loan. For anyone considering a mortgage, now is the time. Be sure to look at the chart below as it shows the current limitations to better rates.

Looking Ahead

Next week our focus will be on inflation readings from the Consumer Price Index, Treasury supply and continued earnings. And, the reemergence of tapered talk with the Fed which also drives the markets and volatility.

Mortgage Market Guide Candlestick Chart

Mortgage-backed securities (MBS) prices are what determine home loan rates. The chart below is the Fannie Mae 30-year 2% coupon, where currently closed loans are being packaged. As prices go higher, rates move lower and vice versa.

MBS were able to rise above their 200-day Moving Average (purple line) but retreated to that level by the week’s end. If prices remain near or beneath this purple line, home loan rates will remain at current levels. Should prices be able to break above the purple line, rates could move another leg lower from here. The opposite is true.

Chart: Fannie Mae 30-Year 2% Coupon (Friday, August 6, 2021)

Economic Calendar for the Week of August 9 – 13

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services, and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors. As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you. Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features, or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.

We are ready to help you find the best possible mortgage solution for your situation. Contact Sheila Siegel at Synergy Financial Group today.