In this Issue…

A Look Into the Markets

Mortgage Market Guide Candlestick Chart

Economic Calendar for the Week of June 14 – 19

A Look Into the Markets

“See people rocking – Hear people chanting – Feeling hot hot hot” – “Hot Hot Hot” by Buster Poindexter

This past week, home loan rates were improving slightly week-over-week until their arch-nemesis, inflation, reared its head on Thursday. Let us break it all down and talk about what it means for you and your clients.

Consumer Inflation and Looking Ahead

On Thursday, the May Consumer Price Index (CPI) showed that consumer inflation rose by 5.0% year-over-year, and after removing the effects of food and energy, the year-over-year rate of inflation was 3.8%.

While the headline showed that 5.00% inflation might be alarming, the bond market’s reaction was a bit restrained. Normally, high inflation numbers would apply heavy selling pressure on bond prices, causing rates to rise. That did not happen. Why?

The bond market is forward-looking. The financial markets were expecting a “hot” inflation reading and have sided with the Fed who continues to say higher inflation over the coming months will be “transitory,” or short-term, in nature. Future readings of CPI will be important to follow to see if the high inflation readings do cool down. If they do, rates will remain low and could continue to improve; the opposite is also true.

9.3M Reasons Why the Fed Won’t Taper

The Federal Reserve, our central bank, has a dual mandate: maintain price stability (manage inflation/deflation) and promote maximum employment. On the latter, the economy is coming up short on the job creation front. The last two jobs reports came in well beneath expectations, and a recent report shows there are 9.3M jobs available in the economy: a record-high figure. So, we have a lot of work to do to get to maximum employment. If that is the case, it is highly unlikely the Fed will taper their monthly bond purchases anytime soon. The Fed has said they need to see “substantial improvement” toward their dual mandate before tapering. What does that mean for you and your clients? It means that long-term rates are likely to remain lower for a longer time.

Be sure to read the chart section below as we discuss the wall, which has limited rate improvement.

Bottom line: This is an amazing moment to take advantage of an interest rate environment that is being manipulated by the Fed bond-buying program. The Fed will continue to buy bonds and keep rates relatively low for quite a bit longer, but if inflation ticks up in the months ahead, we should expect rates to tick up too.

Looking Ahead

It’s Fed Week. There will be a lot of noise and calls for bond “tapering” after this week’s hot inflation number. At the last meeting, the Fed was adamant in their position and stated, “now is not the time,” to even think about tapering. With 9.3M jobs available, let us hope they keep that position, for when the Fed suggests they may start thinking about tapering, long-term rates are likely to move higher, and quickly, much like what happened back in 2013 the last time the Fed mentioned the idea of “tapering.”

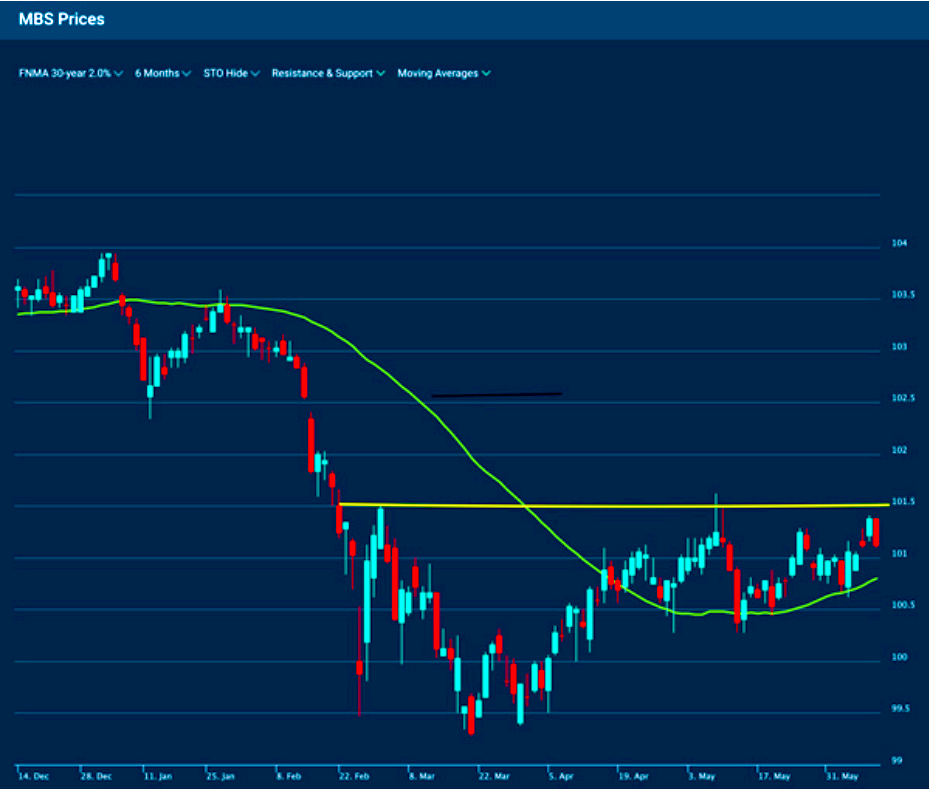

Mortgage Market Guide Candlestick Chart

Mortgage-backed security (MBS) prices are what determine home loan rates. The chart below is the Fannie Mae 30-year 2% coupon, where current closed loans are being packaged. As prices rise, rates decline, and vice versa. Look at the yellow horizontal line; it is like a wall, preventing prices from moving higher. If MBS prices are unable to push above this line, rates cannot improve further. At the same time, if MBS prices can push above this wall of resistance, we could easily see rates improve further.

Chart: Fannie Mae 30-Year 2% Coupon (Friday, June 11, 2021)

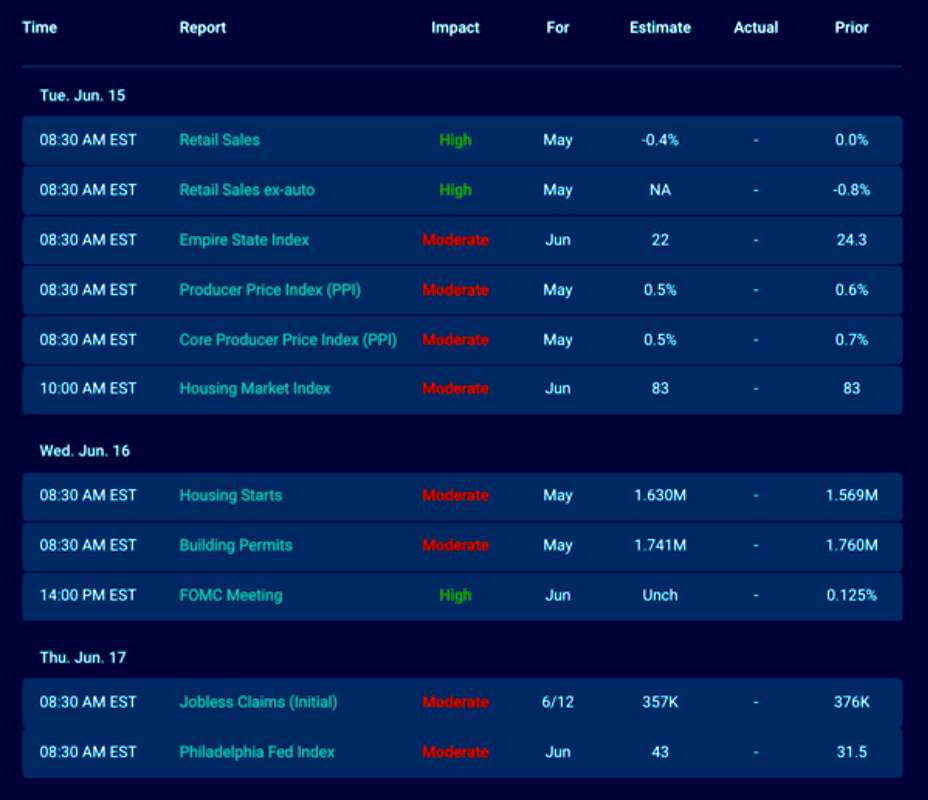

Economic Calendar for the Week of June 14 – 18

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services, and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors. As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you. Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features, or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.

We are ready to help you find the best possible mortgage solution for your situation. Contact Sheila Siegel at Synergy Financial Group today.