In this Issue…

A Look Into the Markets

Mortgage Market Guide Candlestick Chart

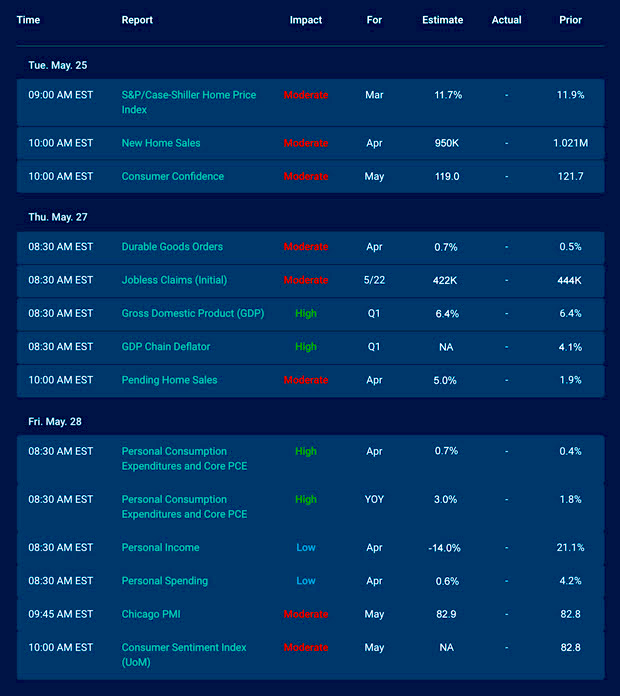

Economic Calendar for the Week of May 24– 29

A Look Into the Markets

“Well, I’m going down / Down, down, down, down, down” – “Going Down” by Jeff Beck

This past week home loan rates held steady despite enormous volatility in the financial markets. Let’s break down what happened and look at what to watch for in the week ahead.

Wacky Wednesday

A “risk-off” trade is when investors sell risky assets like stocks and then park the money in safer investments like bonds and gold. This past Wednesday was one of those odd times when virtually everything went lower in price: stocks, bonds, commodities, US dollars, and cryptocurrencies.

On the latter, cryptocurrencies fell sharply on word China will not embrace Bitcoin for transactions. This “risk-off” selloff seeped into stocks, which fell sharply, and even bonds were not immune to the price decline.

When Buying Demand Doesn’t Meet Selling Demand

Every week the U.S. Treasury sells bills, notes, and bonds to help fund the government. Now with the many different stimulus packages and more on the way, the Treasury is pressured to sell an enormous and ever-growing amount of debt into the bond market.

On Wednesday, the Treasury peddled $27B in 20-yr notes. The buying demand was weak, and as a result, Treasury yields ticked up a touch.

Why is this important to follow? If the Treasury auctions are unable to attract buying demand, rates will be pressured higher to attract investors, and the Fed will be pressured to do more. Remember, the Fed is buying more than $80B of Treasurys every month to help keep long-term rates low.

Timberrrrrrrrrr!

Quick price check on Lumber. It sits near $1300, down nearly $400 in the past week or so. If there is a price we want to see decline, it’s lumber.

One Thing We Want to See Go Down: Prices

A big fear and uncertainty in the financial markets is inflation. The Fed continues to believe that higher inflation in the months ahead will be “transitory” or short-term in nature.

Prices are rising year-over-year because of big changes in oil and food, and those should simmer down in the months ahead. However we did see some sizable month-over-month increases in prices. Hopefully, those will simmer down as well later this year.

For the moment, the 10-yr note yield sits near 1.65% which suggests the bond market is not yet worried about inflation.

The Fed Support Will Continue

The minutes from the previous Fed meeting were also delivered on Wednesday and sparked incredible volatility. At the end of the day, this may be the most important line of the minutes:

“In their discussion of the Federal Reserve’s asset purchases, various participants noted that it would likely be some time until the economy had made substantial further progress toward the Committee’s maximum-employment and price-stability goals.”

Finally, the Fed is not going to stop purchasing bonds anytime soon, which means long-term rates will remain relatively low for a bit longer.

Bottom line: This is no time to get complacent, and while interest rates may not move too high in the near future, they may also not improve much from here as evidenced by what happened this week. Take advantage of what is available today thanks to the Fed bond purchasing program.

Looking Ahead

Next week, the economic calendar is loaded with market-moving reports with readings on housing, inflation, and consumer spending.

Throughout the summer, we should expect to see continued volatility and wait and see if higher inflation is “transitory.”

For the moment, let’s be thankful for the Federal Reserve and the policy response as the bond-buying program continues to support refinance and home purchase activity.

Mortgage Market Guide Candlestick Chart

Mortgage-backed security (MBS) prices are what determine home loan rates. The chart below is the Fannie Mae 30-year 2% coupon, where currently closed loans are being packaged. As prices go higher, rates go lower and vice versa.

Note the sideways trading pattern of the candles. This corresponds with relatively unchanged rates. The next directional move may likely be determined by inflation expectations. If inflation fears elevate, so will rates. The opposite is also true.

Chart: Fannie Mae 30-Year 2% Coupon (Friday, May 21, 2021)

Economic Calendar for the Week of May 24 – 29

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services, and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors. As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you. Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features, or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.

We are ready to help you find the best possible mortgage solution for your situation. Contact Sheila Siegel at Synergy Financial Group today.