In this Issue…

A Look Into the Markets

Mortgage Market Guide Candlestick Chart

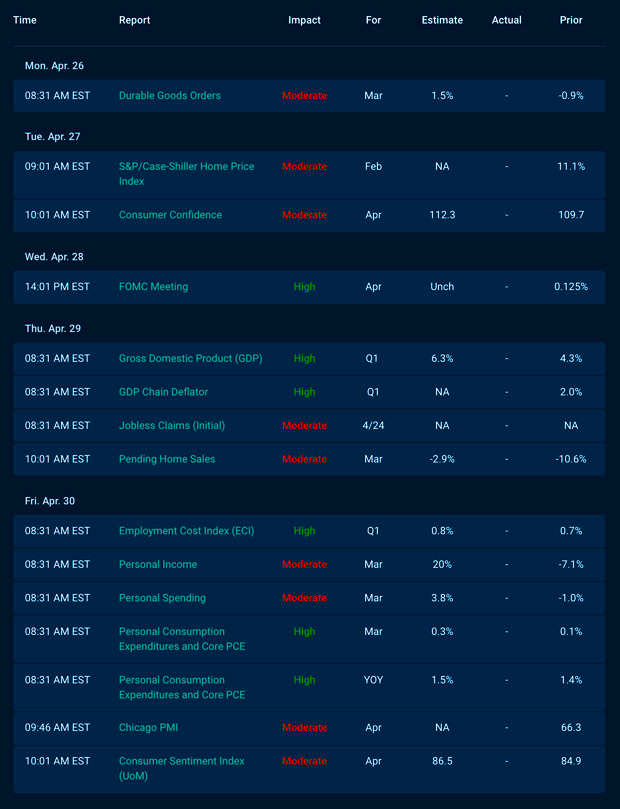

Economic Calendar for the Week of April 26– 30

A Look Into the Markets

“Oh yeah” – “Oh Yeah” by Yello (“Ferris Bueller’s Day Off”)

In the absence of any meaningful economic reports this past week, we watched bond prices rise while rates inched lower. Oh yeah!!!

Let us break down what is going on and look into next week as the boredom ends.

The Path of Least Resistance

Rates have been steadily improving over the past few weeks as consumer inflation fears have waned. With a nice trend in place and no news to knock bonds down, prices continued their path of least resistance: higher. How high? Mortgage-backed securities, which are where home loan rates are derived, closed at their highest level since March 2nd this past week, and the 10-year yield hovered near 1.55%, also the lowest in nearly two months.

FOMC Blackout Period

The Federal Open Market Committee (FOMC), which meets eight times per year to discuss economic conditions and determine whether to hike or lower the Fed Fund Rates, can always move the market when they speak or during interviews.

However, the FOMC has established a blackout period where FOMC members are to limit their public speaking and interviews. The current period is April 17 through 29th. When Fed members are not talking or sharing their views, the markets can’t react to any perceived positive or negative statements. The quiet ends next week when the Fed delivers their Monetary Policy Statement on Wednesday at 2:00 p.m. ET. More on that below.

Bonds Regaining Some Shine

A couple of interesting trends happened this week which could bode well for rates in the near-to-intermediate term. First, stocks struggled a bit this past week, and when they dropped, rates also declined. This is a typical market reaction, but something we have not seen much of this year during the steady increase in rates. If stocks continue to stumble and we see a seasonal, “Sell in May and go away,” reaction, it could leave room for further rate improvement.

Second, the 20-year bond auction this past week was well received. This means the buying appetite for Treasury securities was very good despite the recent improvement in rates/yields. If this trend continues, it will help keep long-term rates relatively low.

Housing en Fuego

March existing-home sales showed the median price rose by an annual record-breaking pace of 17.2%. This scorching rise is due mainly to an anemic 2.1 months of available inventory for sale.

Homes sold in 18 days on average, another record low.

This is all good news for someone selling a home, but as we know, it is rough for folks purchasing one.

With rates ticking back down, vaccinations administered, and economies reopening, we should expect continued strength in housing and hopefully more inventory available for sale.

Bottom line: This is an amazing moment to take advantage of the current interest rates as the present improvement in rates could be short lived.

Looking Ahead

As mentioned, it’s Fed Week. The FOMC will deliver its Monetary Policy Statement as well as its outlook on the economy on Wednesday. There is zero chance of a rate hike. And there is likely no chance the Fed mentions “tapering” of any bond purchases; let’s hope so. For when the Fed stops buying bonds, rates will move higher in a hurry.

We will also get some high-impact reports like Gross Domestic Product and the Fed’s favored gauge of inflation, the Core Personal Consumption Index (PCE).

Moreover, there will be a ton of corporate earnings, which could impact both stocks and bonds/rates.

Mortgage Market Guide Candlestick Chart

Mortgage-backed security (MBS) prices are what determine home loan rates. The chart below is the Fannie Mae 30-year 2% coupon, where current closed loans are being packaged. As prices rise, rates decline and vice versa.

If you look at the right side of the chart, you can see the nice trend higher in prices. If prices can move above the price peak of March 2nd, we will likely see rates move another leg lower. But, if prices are turned back and move lower in response to all the news forthcoming, rates will tick back up.

Chart: Fannie Mae 30-Year 2% Coupon (Friday, April 23, 2021)

Economic Calendar for the Week of April 26 – 30

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services, and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors. As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you. Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features, or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.

We are ready to help you find the best possible mortgage solution for your situation. Contact Sheila Siegel at Synergy Financial Group today.