In this Issue…

A Look Into the Markets

Mortgage Market Guide Candlestick Chart

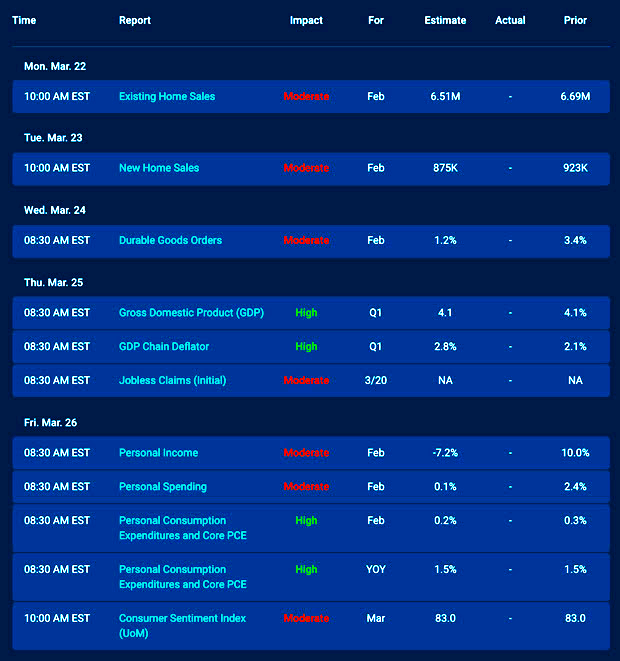

Economic Calendar for the Week of March 22 – March 26

A Look Into the Markets

This past week the Federal Reserve issued their monetary policy statement, as well as new forecasts on the economy, inflation, and rates. Despite all the soft talk on inflation and seeming lack of concern on higher prices ahead, the bond market was not buying it. Let’s break down what happened.

“Strange days indeed, most peculiar Mama” … John Lennon

Fed meetings are always market movers, but this particular one seemed to carry even more weight. The Fed has lost control of long-term rates, as they have ticked higher since January 6, despite the Fed trying to “talk down” inflation on numerous occasions and purchasing $120B worth of bonds per month.

It’s All About Inflation

Mortgage-backed securities (MBS) are the instruments which determine home loan pricing, and inflation is the main driver. If inflation moves higher, rates must move higher. Currently, inflation is not an issue. It is running at 1.7% year-over-year.

The problem? We are going to see much higher inflation over the next few months as year-over-year figures will explode due to the sharp spike in commodities, oil, lumber, and such since last spring.

In the Fed statement and press conference, the Fed continues to acknowledge that inflation will be volatile in the near-term but will moderate back towards a longer-term 2% run rate by next year.

So far, the bond market is not listening or believing the Fed’s outlook on inflation, and after further digestion of their words, bond prices plunged on Thursday, causing rates to touch the highest levels in over a year.

Three Things Bonds Didn’t Like:

Once again, bonds hate inflation, and there were three things from the Fed meeting which spooked bonds and caused the spike higher in rates:

- No “taper” anytime soon, meaning the Fed will continue to purchase at least $120B worth of bonds every month. Normally, you would think this would help rates. Well, the bond market is concerned about the inflationary aspect that continued low rates can fuel. Strange days indeed.

- Fed unity in question. Despite forecasting the next rate hike is not expected until 2024, four Fed members on the committee expect higher rates next year, and seven expect higher rates in 2023. The question of Fed unity on rates and inflation is a reason for the spike.

- Moving the goalposts. The Fed has a dual mandate of maintaining price stability (inflation) and promoting full employment. On the latter, the Fed has added they now want to see maximum employment as “broad-based and inclusive,” meaning the Fed will now potentially add tracking Black and/or Hispanic unemployment before considering hiking rates. The problem for the bond market? This may lead to higher inflation as the Fed will show restraint on hiking rates, because they have a new measure of unemployment to track. Most peculiar Mama.

Bottom line: Rates have resumed their trend higher. As economies reopen, we should expect rates to continue to increase further over time. So if you or someone you know would like to talk about this incredible opportunity, please contact me.

Looking Ahead

The economic calendar is chock full of high impact reports which could move the market, including housing, GDP, and inflation figures.

Moreover, we have a bunch of Treasury auctions. They say the cure for higher rates is higher rates. Will the recent uptick in yields attract some buying which would help provide some rate relief? We shall see.

Mortgage Market Guide Candlestick Chart

Mortgage-backed security (MBS) prices are what determine home loan rates. The chart below is the Fannie Mae 30-Year 2% Coupon, where current closed loans are being packaged. The right side of the chart shows prices at the lowest levels in over a year, which means the highest mortgage rates in a year. Absent a rebound here, which could happen after next week’s big news, the path of least resistance looks lower in price and higher in rate.

Chart: Fannie Mae 30-Year 2% Coupon (Friday, March 19, 2021)

Economic Calendar for the Week of March 22 – 26

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services, and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors. As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you. Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features, or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.

We are ready to help you find the best possible mortgage solution for your situation. Contact Sheila Siegel at Synergy Financial Group today.