In this Issue…

A Look Into the Markets

Mortgage Market Guide Candlestick Chart

Economic Calendar for the Week of February 22 – February 26

A Look Into the Markets

Longer-term U.S. interest rates, including home loan rates, increased sharply this past week, touching pre-COVID levels. Let’s break down the cause and effect as well as some other stories affecting housing.

January Retail Sales Highlight Pent up Consumer Demand

Retail Sales is a monthly report which highlights the health of the U.S. consumer and their willingness and ability to spend. With consumer spending making up nearly 70% of Gross Domestic Product (GDP), it is important to see continued growth in retail sales.

Expectations were for a month-over-month sales growth of 0.8%. Instead, the number came in at 5.3%, five times hotter Save than expectations. It also represented the third strongest month-over-month reading ever recorded.

This incredibly strong January Retail Sales number tells us economies re-opening and more stimulus will likely lead to an uptick in consumer spending and activity and higher GDP. All of this good news about the future is bad news for bonds, hence a reason for the uptick in rates this week.

New Home Builders Looking for Lumber Relief

The National Association of Home Builders (NAHB) continues to report unprecedented strong demand for homes as many tailwinds exist for new housing such as migration from big cities, work from home, and millennial household formation.

But home builders do have a challenge on their hands: lumber inflation. The cost of lumber is up over 170% in the past ten months, thereby adding thousands of dollars to the cost of a home and making it unaffordable for many. In fact, the NAHB said customers are walking away from contracts on new homes due to the additional lumber expense. Builders are reluctant to start new developments, as they are unwilling to start projects and absorb the added cost. This could be one reason why January Housing Starts, reported on Thursday, were well below expectations. Where is the relief? It could come through lumber tariff relaxation with Canada and a push for U.S. lumber producers to significantly ramp up production to put a dent in the demand.

Inflation, like we are seeing in lumber and other commodities, is bad for rates and another reason for the recent uptick in home loan rates.

Supply Outweighing Demand

The Federal Reserve has committed to purchase at least $120B worth of Treasurys ($80B) and mortgage-backed securities ($40B) (MBS) per month in an effort to keep long-term rates, like mortgages relatively low.

The recent problem? The Fed has been on a pace to purchase $30B in MBS each of the last couple of weeks, yet rates ticked UP. This is because nearly $100B in MBS were available for sale, and the Fed only purchased one third available.

So basic economics kicks in. If supply outweighs demand, prices drop and, in the case of bonds, rates tick higher.

Bottom line: There is an old saying in the bond market: Cure for higher rates, is higher rates. Meaning, at some point, the uptick in yields makes investing or buying bonds more attractive. We have not hit that point yet. If you or someone you know would like to talk about the incredible opportunity that still exists, please contact me.

Looking Ahead

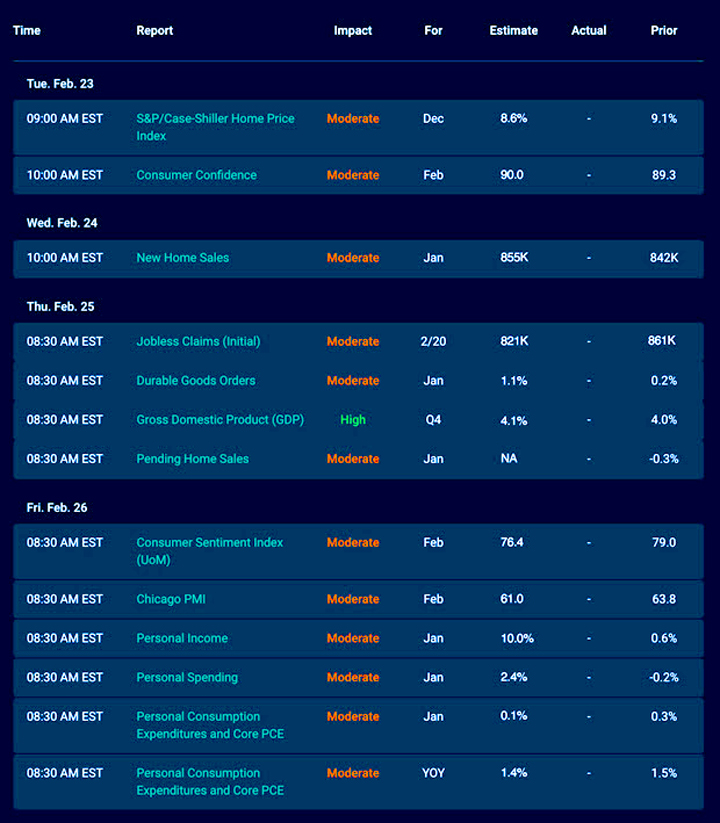

Next week brings a bunch of high-impact reports which could move the market, including GDP, Durable Goods, and the Fed’s favorite gauge of inflation, Personal Consumption Index.

Additionally, the bond market will need to deal with more supply by way of new bond issuance and auctions of 2,5, and 7-Year Notes. The additional supply has been a weight on prices, helping cause the uptick in rates.

Mortgage Market Guide Candlestick Chart

Mortgage-backed security (MBS) prices are what determine home loan rates. The chart below is the Fannie Mae 30-Year 2% Coupon, where current closed loans are being packaged. The right side of the chart shows prices falling through support at the 200-day moving average (purple line). That is bad news for rates. The glimmer of hope? The little green candle on the far right side of the chart suggests the recent downtrend in prices “is at risk,” meaning we could see some sideways movement or outright price improvement from here. Let’s hope so.

Chart: Fannie Mae 30-Year 2% Coupon (Friday, February 19, 2021)

Economic Calendar for the Week of February 22 – 26

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services, and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors. As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you. Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features, or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.

We are ready to help you find the best possible mortgage solution for your situation. Contact Sheila Siegel at Synergy Financial Group today.