In This Issue…

Last Week in Review: Too Much of a Good Thing for Rates.

Forecast for the Week: Action Packed Calendar Ahead.

View: 3 Tips for Staying Focused on Developing Your Business.

Last Week in Review

Too Much of a Good Thing for Rates

Bonds and home loan rates hate good news. So, the influx of positive news abroad coupled with strong jobs data here in the U.S. pressured Mortgage Bonds lower and home loan rates higher.

Bonds and home loan rates hate good news. So, the influx of positive news abroad coupled with strong jobs data here in the U.S. pressured Mortgage Bonds lower and home loan rates higher.

The main event, which helped Stocks and hurt home loan rates, included fresh progress on the U.S./China trade front as both parties are set to meet once again in October. To be clear here, a U.S./China trade deal would be incredible for the entire global economy as it would spark more trade talks and deals around the world. If a deal is had, home loan rates will suffer — the opposite is also true.

Bonds and home loan rates also hate uncertainty. So, when some uncertainty was lifted, as Brexit now appears to be on hold for the time being, this also helped Stocks at the expense of home loan rates. Finally, seeing uncertainty removed in Hong Kong as protests simmer down was yet another hurdle for U.S. Bonds to contend with.

The Goldilocks economy in the U.S. continues. August jobs growth remains strong, the consumer continues to spend, and there is no recession in sight. All this good news and we still have home loan rates hovering near three-year lows.

Bottom line: the ability to borrow money this cheap to either refinance or purchase a home will not last forever, so take advantage. If the Fed and global banks are successful in keeping economic expansion alive, today’s rates will be in the rearview mirror.

If you or someone you know has questions about home loans, give me a call. I’d be happy to help.

Forecast for the Week

Action Packed Calendar Ahead

Trade and Brexit news, fears of a global economic slowdown, and a strong dollar will continue to influence the U.S. markets in the upcoming week while key consumer data will be released.

The post Labor Day rally for Stocks weighed on Bond prices in recent days while global yields increased. After the August decline, investors were looking for some bargains in the equity markets and have pushed the closely watched S&P 500 up 5% from the mid-August lows.

The markets will be eagerly awaiting the numbers from August Retail Sales to gauge if the consumer remains strong and continues to spend their hard-earned dollars. Consumer spending makes up a big chunk (70%) of Gross Domestic Product and is vital for economic expansion. In addition, the inflation reading Consumer Price Index will be released, though we don’t see any upside pressure to inflation.

There will be no Fed speak this week as the blackout period begins ahead of the September 17-18 Federal Open Market Committee meeting.

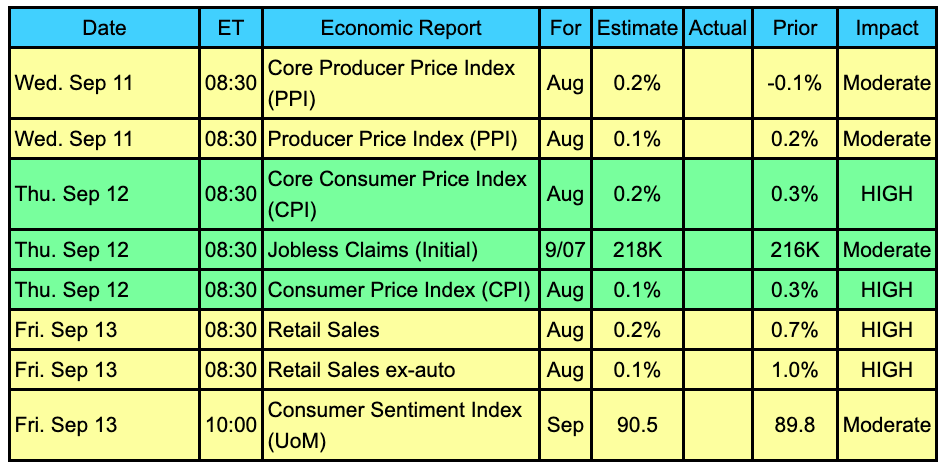

Reports to watch:

- Inflation data will come from Wednesday’s Producer Price Index and Thursday’s Consumer Price Index.

- Retail Sales and Consumer Sentiment will be released on Friday.

Chart: Fannie Mae 3.5% Mortgage Bond (Friday, September 6, 2019)

The Mortgage Market Guide View…

3 Tips for Staying Focused on Developing Your Business

Do you think you need to be full steam ahead during the development phase of your business? Or that everything will fall apart if you’re not there? If this sounds like you, you’re getting too close to the forest to see the trees and need to step back. If you don’t slow down and relax, your worst nightmares may come true because you’re too exhausted to handle them. Here are three tips to stay focused on your business and take care of yourself.

First, just take a break. Get out of town for a couple of days or a week and get your mind out of the business. The work will still be there when you return, and you can do a better job of running it because you’ve had an opportunity to relax. You also avoid getting burned out because you took a break.

Set realistic goals for yourself. You can’t do everything all the time. That is, you might think you can get everything done in one day or a week and not fall behind. The truth is, though, that you’re more likely to drop the ball if you have too much to do. Focus on what’s important for the day and take care of the rest later.

Ask for help. If you’re finding that you’re overwhelmed with everything that you need to do, get help. Don’t be afraid to hire someone to take some of the work off your hands. Give them the work that’s easy to do, hard to mess up, and increase their responsibilities over time so you can slow down a little.

Sources: AllBusiness.com, Entrepreneur.com, SCORE Association

Economic Calendar for the Week of Sep 9 – Sep 13

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors.

As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you.

Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.

We are ready to help you find the best possible mortgage solution for your situation. Contact Sheila Siegel at Synergy Financial Group today.