In This Issue…

A Look Into the Markets

Mortgage Market Guide Candlestick Chart

Economic Calendar for the Week of October 19 – October 24

A Look Into the Markets

“Good times, bad times. You know I had my share.”

— Good Times Bad Times, Led Zeppelin

U.S. Bond Market = Safe Haven

This past week, investment dollars around the globe flooded into the U.S. Treasury market as a “safe haven” against growing uncertainty in Europe. Germany, France, and other European countries are seeing record levels of COVID-19 cases and have to decide on if and how to shut down parts of their economy.

At the same time, the European Central Bank (ECB) has not yet shown the willingness to add even more stimulus.

As a result of these bad times in Europe, Bond yields fell further into negative territory with the German 10-year Bund yield falling to -.64%, the lowest since March, and near all-time lows.

The decline in European Bond yields pressured our Treasury yields lower, from .79% on Monday to .69% on Thursday.

Not All Bonds Are Created Equal

The decline in Treasuries doesn’t mean lower home loan rates. Home loan rates come from the pricing of mortgage-backed securities — which didn’t improve this week along with Treasuries — so mortgage rates didn’t improve either.

It’s Not All Bad and Uncertain

Despite the growing uncertainty abroad, here in the U.S. we continue to see solid economic reports, strong consumer spending and corporate earnings. And on top of that, a large stimulus package is coming. Along with a stimulus package comes three things Bonds don’t like:

- Added supply of Treasury notes and Bonds to be sold

- Increased inflation fears

- Aid to the U.S. economy

Bottom line: Rates are at all-time lows and may not be here for long. If you or someone you know would like to talk about the incredible opportunity for housing, please contact me.

Looking Ahead

October is historically volatile for the financial markets and we are seeing it again this month. Despite the major headlines to follow, such as stimulus negotiations and Europe, the U.S. Bond market will have to absorb billions of dollars in new Treasury supply being sold at auction. It is this new supply referenced above, that another stimulus package could pressure rates higher.

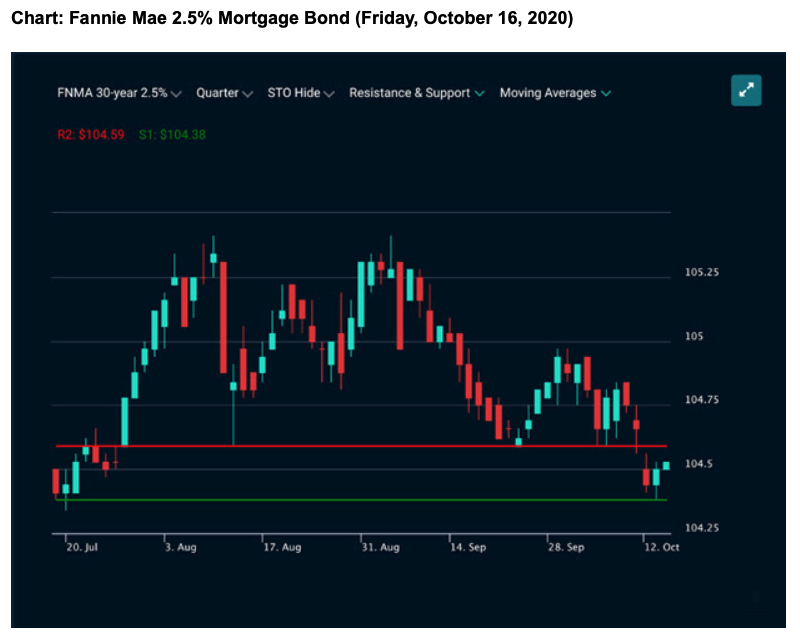

Mortgage Market Guide Candlestick Chart

Despite the uncertainty and problems in Europe and the decline in Treasury yields, mortgage-backed security prices fell beneath support at the red horizontal line (104.59), which now becomes resistance. The chart shows the clear overall decline in Mortgage Bond prices since the start of September. This means there is a limit to how much home loan rates can improve, if at all.

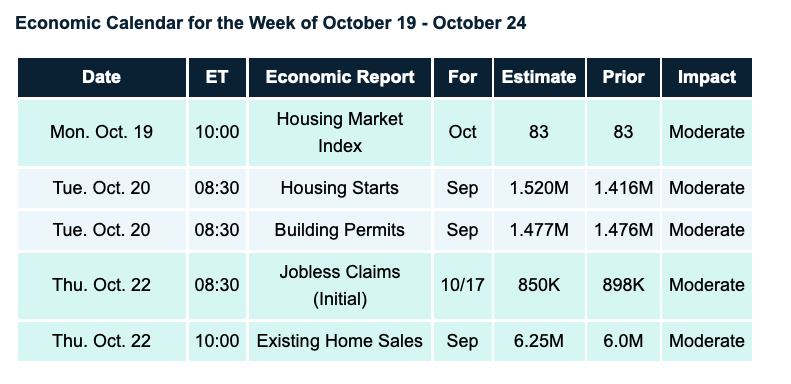

Economic Calendar

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services, and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors. As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you. Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features, or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.

We are ready to help you find the best possible mortgage solution for your situation. Contact Sheila Siegel at Synergy Financial Group today.