In This Issue…

A Look Into the Markets

Mortgage Market Guide Candlestick Chart

Economic Calendar for the Week of October 5 – October 9

A Look Into the Markets

COVID-19 Hits the White House

Friday morning, President Trump and the first lady tested positive for COVID-19. The news shocked the financial markets around the globe, with global Stocks declining in response to the uncertainty. The news adds the potential for large market swings as we approach the general election in just a few weeks.

Stimulus or No Stimulus

Another big story to follow as it relates to the economy and financial markets is if and when Congress can agree on a fresh fiscal stimulus plan. As of Friday, Congress has been unable to agree on a plan and this has added to the already incredible uncertainty for the financial markets. Stocks endured heavy losses in September due most in part to the political uncertainty and the lack of a new stimulus plan. Will Congress come together with a large plan to help the economy recover further? If so, how much? And when? These are the questions the financial markets are looking to have answered.

Bright Outlook for Housing

This past week, Pending Home Sales, a forward-looking view on housing, showed the highest reading since 2006. The demand for housing is very strong and the confidence required for individuals to purchase a home cannot be understated. There’s a lot of optimism in the housing sector and the tailwinds of low mortgage rates, an improving economy, and continued improvement in the labor market should fuel housing for the foreseeable future.

Back to Work

Low rates are wonderful, and it’s a major driver of housing and will likely be for quite some time. However, if you don’t have a job, you can’t pay a mortgage. The good news is that jobs continue to return. The September Jobs Report, reported this Friday, showed the unemployment rate at 7.9%, a major improvement from the 14.7% seen in the darkest moments of COVID-19 back in April. We should expect continued improvement in the labor market as states continue to re-open and heavily impacted sectors of our economy — such as travel, leisure, and hospitality — attempt to recover. As mentioned, housing will continue to benefit from the improved conditions.

Bottom line: Rates are at all-time lows and even though a fourth stimulus package is up in the air, we are hopeful it will happen. And if a package is agreed upon, it will likely be good for Stocks and bad for Bonds as it brings even more supply and inflation fears. If you or someone you know would like to talk about the incredible opportunity for housing, please contact me.

Looking Ahead

The markets have to contend with many unknowns, and the progress of President Trump’s health and its impact are at the top of the list. This will be a day-to-day affair for the next couple of weeks, which, as mentioned, could create big market swings.

October has historically been a month where we have seen sharp moves in both Stocks and Bonds. This October looks to be no different. Stocks declined sharply in September and rates didn’t improve further. What happens if Stocks move sharply higher in October if some uncertainty is lifted? Yes, long-term rates could tick higher off these historic lows.

Mortgage Market Guide Candlestick Chart

Mortgage-backed security prices are trading near support (horizontal green line) as we enter October. With so much headline risk, we are watching to see if prices remain above this green line. If we see more positive economic news and a stimulus plan, we could see Mortgage Bond prices fall beneath this support level, causing an uptick in home loan rates. The opposite is also true.

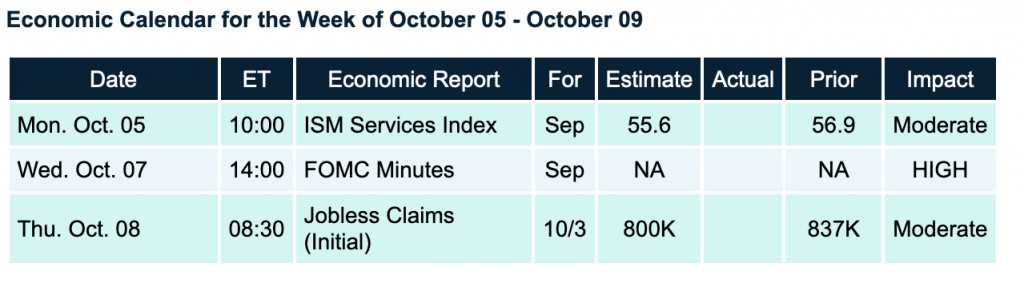

Economic Calendar

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services, and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors. As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you. Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features, or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.

We are ready to help you find the best possible mortgage solution for your situation. Contact Sheila Siegel at Synergy Financial Group today.