In This Issue…

A Look Into the Markets

Mortgage Market Guide Candlestick Chart

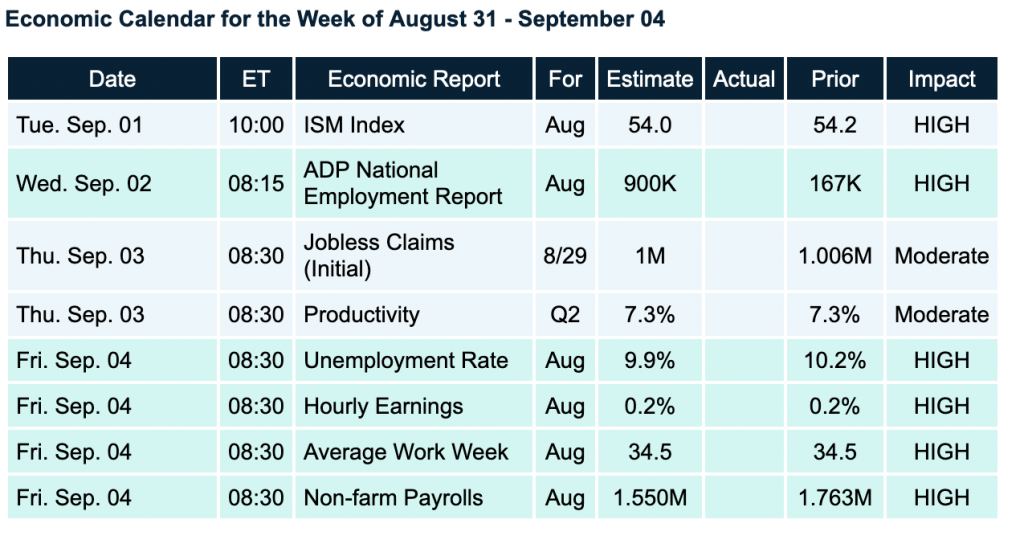

Economic Calendar for the Week of August 31– September 04

A Look Into the Markets

“I’m going to Jackson, I’m gonna mess around.” — June Carter Cash and Johnny Cash

This past week, the Jackson Hole Economic Symposium took place. This annual event which started back in 1981 is attended by central bankers, finance ministers, and other officials from around the globe, to discuss and deliver speeches on important economic issues facing worldwide economies.

History has shown this event to deliver market-moving comments and major Fed policy announcements. And this past Thursday, the event didn’t disappoint.

Fed Announced Big Changes at Jackson Hole

First, let’s remember the Fed’s role. The Fed has a dual mandate of promoting maximum employment and price stability. Currently, unemployment is too high at 10.2%, and inflation — as defined by the Fed’s favorite gauge, Core PCE — is too low at 1.3%.

On Thursday, Fed Chairman Jerome Powell announced a major policy shift to help lift inflation, promote job growth, and make it very clear to the financial markets that rates will remain lower for longer.

The Fed is going to remove its 2% target for inflation and allow inflation to drift higher and remain there for some time before hiking rates.

In addition to allowing inflation to rise, the Fed will also allow the labor market to run “hotter” and create even more jobs before considering a rate hike.

This major policy change is the exact opposite of how the Fed previously addressed inflation and improving economic conditions, with frequent rate hikes “before” inflation and the labor market heated up.

What Does the Fed’s Move Mean?

First, it means that the Fed is not likely to hike the Fed Funds Rate for years. So, short term rates like auto loans, home equity lines of credit, and credit cards will remain near current levels for quite some time. Savings accounts will also offer no meaningful interest for savers.

Next, if inflation rises like the Fed wants, home loan rates will rise — period. Inflation is the tide that raises all boats. The good news: Inflation is currently very low and that’s what’s keeping home loan rates near all-time lows … for now.

The Opportunity for Homeowners

Finally, would-be homeowners would be wise to take advantage of current mortgage rates and low inflation because if both rise, you want to be an owner and not a renter of real estate.

In an era of higher inflation and a “hot” labor market, which is what the Fed wants, wages and prices go up. One would want to lock in a mortgage at current rates and make that fixed payment with rising wages over time. Renters will be paying higher rent with higher wages.

One last benefit is that real estate is a real asset and a great hedge on inflation as home prices climb even faster with rising inflation.

Bottom line: If you or someone you know would like to talk about the incredible opportunity to housing — please contact me.

Looking Ahead

Next week, we will get to see important labor market readings with the ADP and the August Jobs Report. With over 16 million Americans unemployed, a lot of work still has to be done to get unemployment to where it was in February, pre-COVID-19.

Mortgage Market Guide Candlestick Chart

Mortgage Bond prices remain elevated and just beneath all-time price highs, with mortgage rates just above all-time lows.

Economic Calendar

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services, and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors. As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you. Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features, or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.

We are ready to help you find the best possible mortgage solution for your situation. Contact Sheila Siegel at Synergy Financial Group today.