In This Issue…

A Look Into the Markets

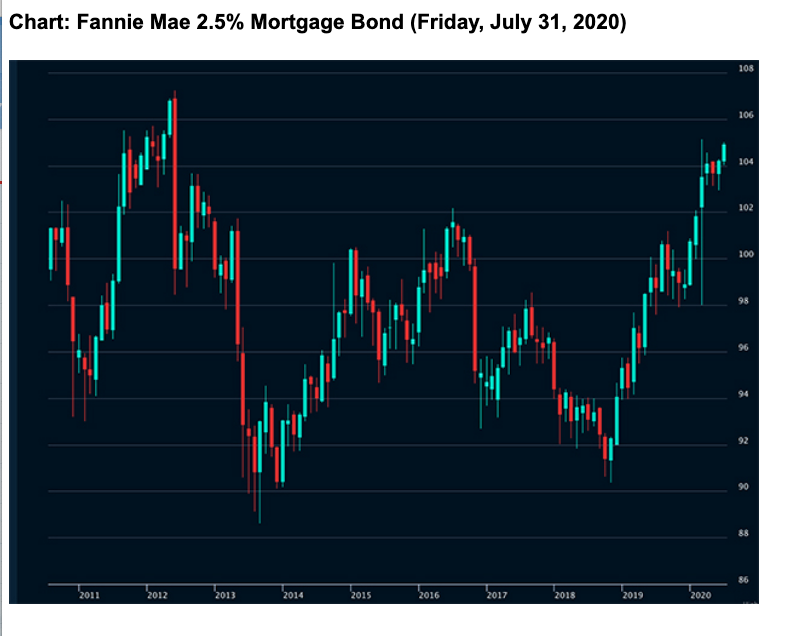

Mortgage Market Guide Candlestick Chart

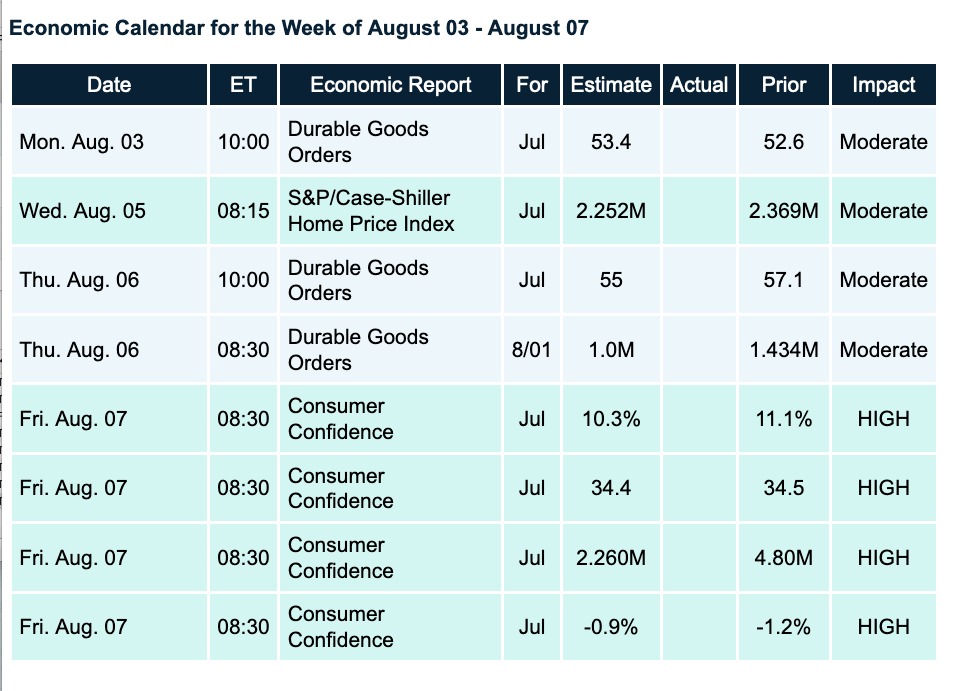

Economic Calendar for the Week of August 3 – July 31

A Look Into the Markets

“The path of the economy will depend significantly on the course of the virus.” — Fed Monetary Policy Statement, July 29, 2020

The Good:

This past week, home loan rates hovered at all-time lows in response to uncertainty surrounding the economic impact of COVID-19 and the realization that the Fed will keep rates low for a very long time.

The 10-year Note yield has moved convincingly beneath .60% for the first time since March 9th and that could lead to a further decline in yield in the days, and potentially weeks, ahead. This means that mortgage-backed securities, the driver of home loan rates, will have room to improve even further.

Housing continues to be the bright spot in the U.S. economy. Pending Home Sales soared this week and the real estate community has boosted their sales forecasts for 2020, suggesting the good times in housing will continue for the foreseeable future.

The Bad:

Stocks hate and Bonds love uncertainty. There was plenty of it this past week.

On Thursday, President Trump issued a tweet suggesting the election will be delayed until people can vote in person safely.

Technology shares, which have risen sharply since the lows in late March, experienced sharp price losses midweek as CEOs from Apple, Google, Amazon, and Facebook were gathered for an antitrust hearing and “grilled” by lawmakers on Capitol Hill. The hearings elevated fears that further regulation, and potentially the breakup of some very large companies like Amazon and Google, are in the future. Come Thursday, the argument that these firms are too big might have become stronger as each firm posted very strong corporate earnings and guidance, sending their Stock shares to all-time highs heading into the weekend.

Congress, which can never seem to agree on anything, is at it again this week as both sides are not even close to coming up with a new stimulus measure to further help the economic recovery. There is likely to be a resolution, but it’s unclear as to when and how significant it will be.

The Ugly:

Gross Domestic Product (GDP), which measures U.S. economic output, came in at -32.9% for the second quarter. This was the worst quarterly economic decline in U.S. history. The markets were expecting an ugly number so the market reaction to this backward-looking data was a bit muted.

On a brighter note, it appears the recession ended in the second quarter while the third quarter is likely to show the largest increase in GDP in U.S. history. This is also expected as the economy improves sharply from what essentially was a shutdown for most of the U.S. economy.

Looking Ahead:

Next week will provide a look into the labor market with the ADP report on Wednesday and the Jobs Report on Friday. At the moment, unemployment is too high, and inflation is too low, so the Fed is not likely to raise rates for years.

Bottom line: Housing continues to shine, and unemployment continues to decline, but at a slower pace due to COVID-19. Rates are at a historic low with a chance to move even lower, and the Fed just told us they are likely to remain low for the foreseeable future.

If you or someone you know has questions about home loans, give me a call. I’d be happy to help.

Mortgage Market Guide Candlestick Chart

Mortgage-backed securities remain in a long-term uptrend that started back in November 2018, ironically when the Fed was hiking rates. The trend remains our friend and we could see even lower rates in weeks and months ahead.

Economic Calendar

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services, and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors. As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you. Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features, or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.

We are ready to help you find the best possible mortgage solution for your situation. Contact Sheila Siegel at Synergy Financial Group today.