In This Issue…

A Look Into the Markets

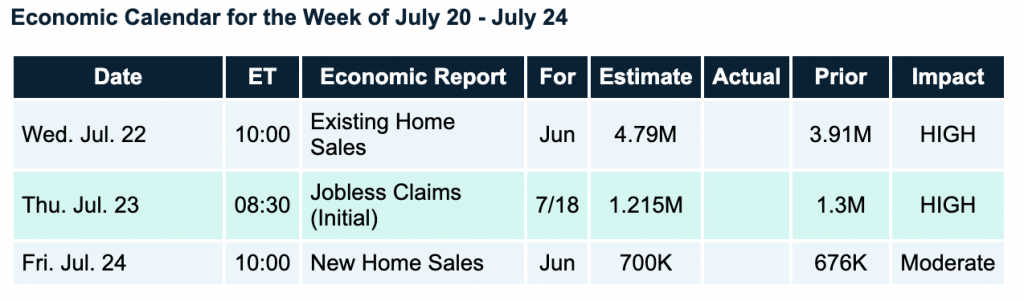

Economic Calendar for the Week of July 20 – July 24

A Look Into the Markets

This past week, the National Association of Home Builders (NAHB) reported that their Sentiment Index for June rose sharply to 72, thereby lifting the index to exactly where it was in March, prior to COVID-19.

Within the report there were sharp increases in the following three components:

- Sales conditions

- Sales expectations

- Buyer traffic

Builders in the Northeast and Midwest are seeing a surge in demand after being sidelined from COVID-19.

One of the interesting parts of the report came from Robert Dietz, NAHB’s chief economist, who shared this, “Nonetheless, the important story of the changing geography of housing demand is benefiting new construction. New home demand is improving in lower density markets, including small metro areas, rural markets, and large metro exurbs, as people seek out larger homes and anticipate more flexibility for telework in the years ahead. Flight to the suburbs is real.”

On top of this great housing story, Freddie Mac reported that the average 30-year mortgage hit an all-time low of 2.98%, making homebuyers feel very good.

Bottom line: Housing will continue to shine for the foreseeable future as low rates, household formation, migration to suburbs, and flexibility to work remotely provide a tailwind.

If you or someone you know has questions about home loans, give me a call. I’d be happy to help.

Mortgage Market Guide Candlestick Chart

Mortgage Bonds continue to hover near multi-year highs while home loan rates fell to record lows in the latest survey.

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services, and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors. As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you. Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features, or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.

We are ready to help you find the best possible mortgage solution for your situation. Contact Sheila Siegel at Synergy Financial Group today.