In This Issue…

A Look Into the Markets

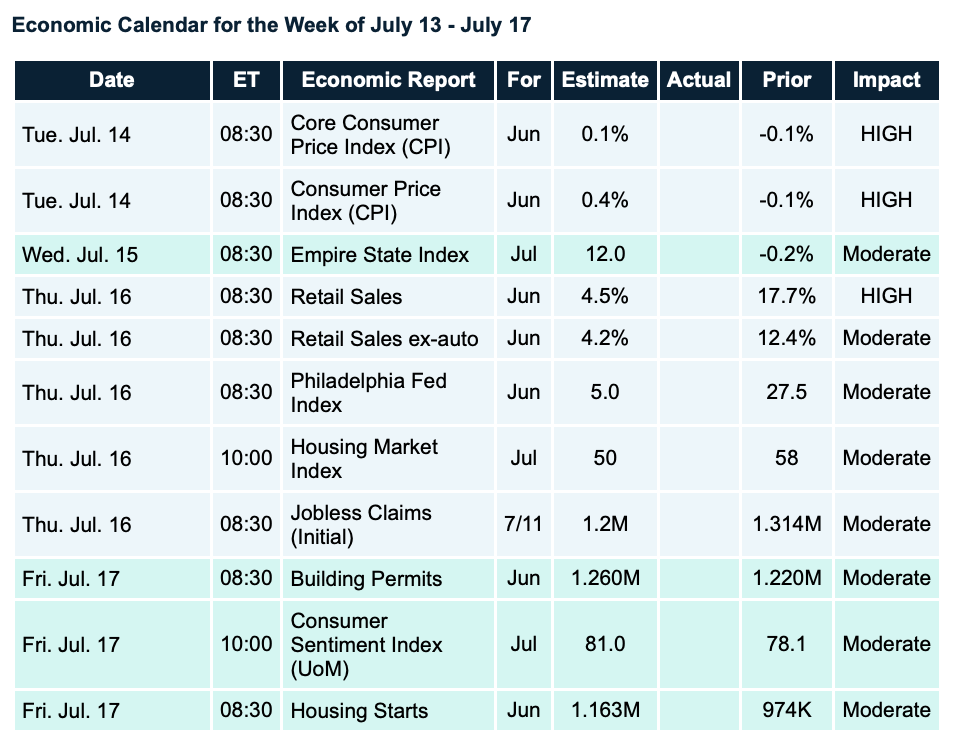

Economic Calendar for the Week of July 13 – July 17

A Look Into the Markets

This past week, Freddie Mac reported mortgage rates hit an all-time low of 3.03%. What is most impressive with the improvement in mortgage-backed security prices and rates, is it happened as Stocks enjoyed nice gains, with the NASDAQ hitting all-time record highs.

Typically, when Stocks improve in price, it is at the expense of Bonds and rates, but not this week.

On Wednesday, the markets received a signal suggesting rates will remain low for quite some time and they might even go lower.

Every couple of weeks the Treasury Department sells or auctions off Treasury Notes and Bonds to help fund our government. Now, with the unprecedented amount of stimulus, the Treasury will be selling even more Bonds for a long time to cover the tab.

The good news? The buying appetite for the 10-year Note auction was the best ever — with the yield hitting a record low .65% in the auction.

This means investors continue to seek the “safe haven” of the 10-year Note from other markets, and even though investors are only receiving a paltry .65% yield, it far outweighs other yield options around the globe where negative rates are common.

Heading into the weekend, the 10-year Note yield had dropped further and beneath .60% for the first time in months and only did so a couple of times. This is important to follow as a sustained move beneath .60% would help push mortgage-backed securities higher and pull home loan rates lower.

Bottom line: Interest rates are going to remain relatively low for a long time, which will help many families restructure their debt while providing a tailwind for housing for the foreseeable future.

If you or someone you know has questions about home loans, give me a call. I’d be happy to help.

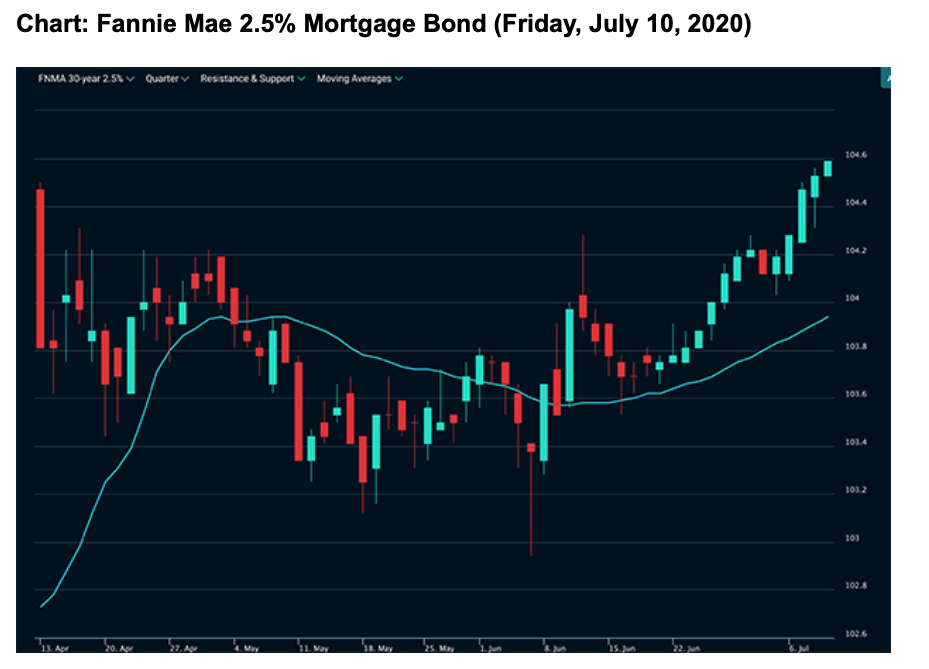

Candlestick Chart

As you can see in the chart, Mortgage Bonds have pushed higher in recent weeks and are just below the all-time highs seen back in mid-March, at the height of the pandemic shutdown, while mortgage rates are at the lowest levels since Freddie Mac began record-keeping in 1971.

Chart: Fannie Mae 2.5% Mortgage Bond (Friday, July 10, 2020)

Economic Calendar

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services, and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors. As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you. Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features, or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.

We are ready to help you find the best possible mortgage solution for your situation. Contact Sheila Siegel at Synergy Financial Group today.