In This Issue…

A Look Into the Markets

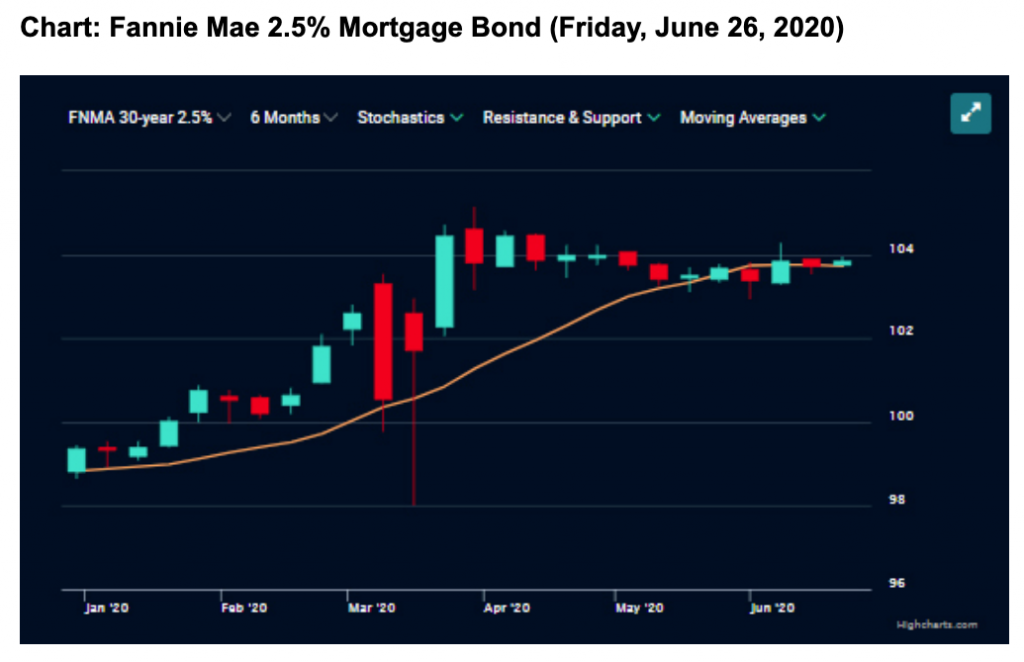

Mortgage Market Guide Candlestick Chart

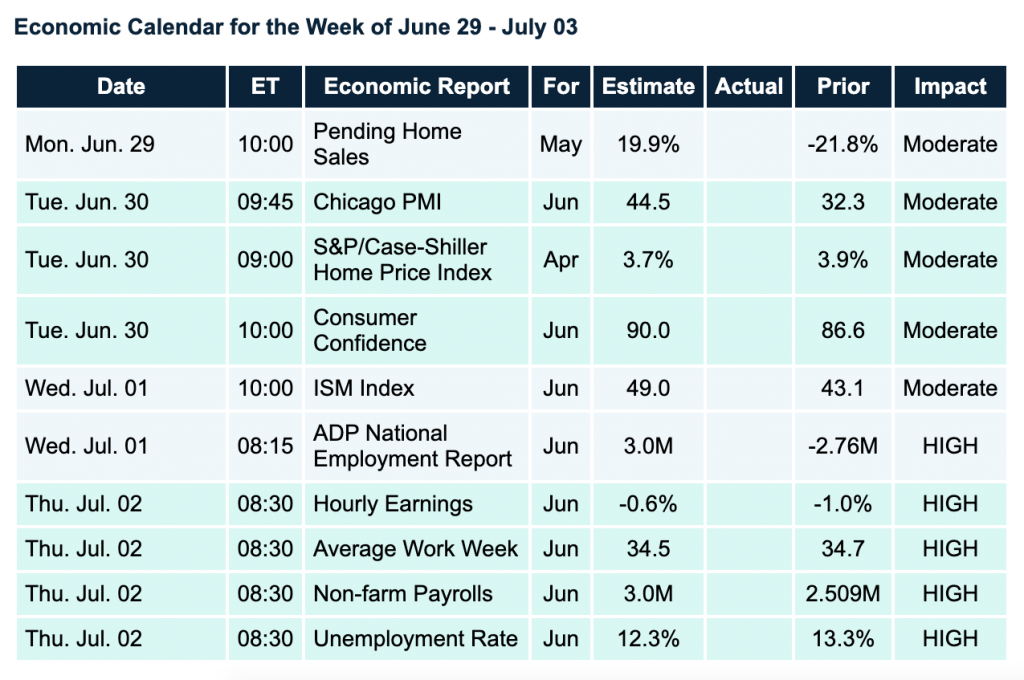

Economic Calendar for the Week of June 29 – July 03

A Look Into the Markets

Home loan rates continue to hover at historic lows, presenting an incredible opportunity for existing and future homeowners.

Will rates move another leg lower or is this the bottom? Stocks had a rough week. What’s next for them?

There are 3 things to track as we move through summer:

- Spikes in coronavirus cases in several states: This is a real concern that comes with both a human and economic toll. We have to watch and pray that hospitalizations don’t increase significantly. From an economic standpoint, there will be a negative effect. At the very least, it delays state re-openings and continues the “incremental” improvement in the economy. Should cases rise significantly and cause even more chaos, Stocks may decline, thereby helping Bonds and rates.

- Overwhelming policy response: The Fed, Treasury, and administration are spending trillions of dollars to help underwrite the economic recovery, and many trillions more will be spent. There are rumors that another PPP (Paycheck Protection Program) plan will come together before Congress recesses in August. There is also a $1 trillion infrastructure bill being debated. In addition, the Fed will continue to purchase mortgage-backed and Treasury securities in the open market, and will hold rates near zero for as far as the eye-can-see. Stimulus helps both Stocks and Bonds, but Stocks even more, as the overwhelming support takes a bit of risk out of the markets … hence the term, “Don’t fight the Fed.”

- Watch the technicals: For all rates — including home loan rates — to improve much further, the 10-year yield has to move beneath .60%. This is something that has only happened a couple of times during the darkest moments of COVID-19. For Stocks, the S&P 500 is trying to remain above its 200-day moving average, currently at 3,020, an important technical marker. If Stocks regain some of this week’s losses, it could be at the expense of Bonds and rates. Should the S&P 500 move sharply beneath its 200-day moving average, we will likely see an extended selloff, thereby helping Bond prices.

The next directional move in the financial markets and the overall economy will likely be determined by the first two bullets, with the technicals further confirming this move.

Bottom line: With rates at all-time lows, now is a wonderful time to lock in a mortgage. No one knows what the future will bring, but we do know the policy response will continue to grow which generally helps Stocks and limits Bond/rate gains.

If you or someone you know has questions about home loans, give me a call. I’d be happy to help.

Mortgage Market Guide Candlestick Chart

Mortgage Bond prices continue to remain in a sideways pattern as the Fed continues to hold rates near all-time lows.

In the coming weeks, prices will be impacted by which direction U.S. Stocks take and if the 10-year yield can remain above a key technical level.

Economic Calendar

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services, and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors. As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you. Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features, or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.

We are ready to help you find the best possible mortgage solution for your situation. Contact Sheila Siegel at Synergy Financial Group today.