In This Issue…

Last Week in Review: A Look Into the Markets

A Look Ahead: Mortgage Market Guide Candlestick Chart

View: Economic Calendar for the Week of June 15 – June 19

Last Week in Review:

A Look Into the Markets

About every six weeks the Federal Reserve meets and decides whether to make potential changes to the Fed Funds Rate, an overnight lending rate. They also release their Monetary Policy Statement which includes the reasoning for their action or inaction.

This past week, it was Fed Week and while they didn’t change rates or offer any big surprises it was the actual “zero” which ultimately hurt Stocks and helped Bonds and home loan rates.

The Fed said they are likely to keep the Fed Funds Rate at the current rate of zero, potentially through 2022.

Why would the Fed not hike rates for possibly 18 months or more?

It’s important to understand the Fed’s dual mandate and primary functions: to promote full employment and manage price stability (inflation). At the moment unemployment is highly elevated at 13.5% and it will take time for the labor market to get back to the 3.5% we saw just a few months ago.

The other reason is inflation or price stability. At the moment, inflation is running well below the Fed’s target of 2.00% and is likely to do so for the foreseeable future. With inflation currently no threat, there is no pressure for the Fed to raise rates.

What does this mean for mortgage and housing? Mortgage-backed securities are Bonds that influence home loan rates. Inflation is the main driver which pushes them higher or lower. If inflation indeed remains low as the Fed is currently forecasting, then home loan rates will remain relatively low for the foreseeable future.

Supporting the notion for low inflation in the near-term is the incremental re-opening of states and businesses. This will make consumer demand return more slowly as well.

In addition to the status quo on rates, the Fed also said they will continue to buy Treasuries and mortgage-backed securities on a daily basis to “sustain smooth functioning” of the markets. This action will also help keep home loan rates lower for longer.

The bottom line: The backdrop for housing and the economy continues to be bright. Inflation is low, jobs are returning, consumers are eager to spend, housing demand is increasing, and we should expect the Fed, Treasury, and administration to do whatever it takes to underwrite a full economic recovery.

If you or someone you know has questions about home loans, give me a call. I’d be happy to help.

A Look Ahead:

Mortgage Market Guide Candlestick Chart

Mortgage Bonds move higher, home loan rates move lower. The two-year chart below clearly shows prices increasing over time and touching the highest levels ever, which means the lowest levels ever!

The large green candle on the far right shows the big improvement in pricing and rate in response to the Fed, Stock selloff, and uncertainty around coronavirus.

View:

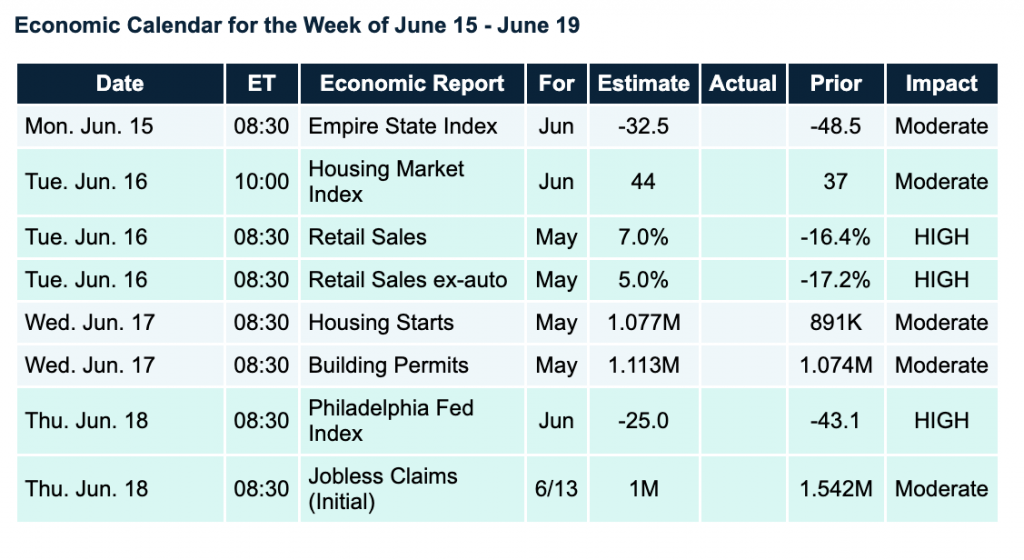

Economic Calendar for the Week of June 15 – June 19

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services, and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors. As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you. Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features, or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.

We are ready to help you find the best possible mortgage solution for your situation. Contact Sheila Siegel at Synergy Financial Group today.