In This Issue…

Last Week in Review: Home Loan Rates Have Stabilized

A Look Ahead: Treasury Securities Offered

The Mortgage Market Guide View: The Importance of Dressing Up for Online Meetings

Last Week in Review:

Home Loan Rates Have Stabilized

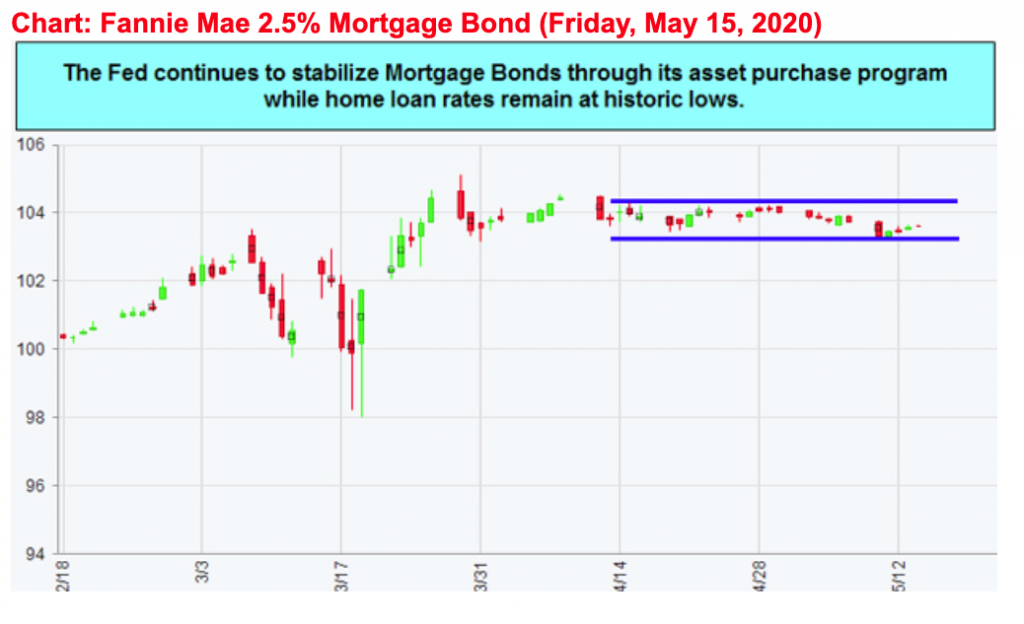

Home loan rates remain near historic lows and have stabilized, thanks mainly to the Federal Reserve, as the central bank continues to purchase mortgage-backed securities on a daily basis.

The Fed also helped rates this past week in another way, but it may have been unintentional. Fed Chairman Powell spoke last Wednesday and uttered remarks that lifted uncertainty about the economic recovery. By saying the U.S. is facing an “extended period” of economic weakness, Stocks fell sharply, providing an improvement to rates.

The reality is the U.S. economic recovery is likely to be gradual as states re-open at a slower pace, while consumer demand may take some time to return to more normal levels. At the same time, we should expect the Fed, Treasury, and U.S. government to do whatever it takes to help the economy through this deep, yet temporary, recession — and revive it upon coming out of the other side of the virus.

The next couple of weeks are important to see whether the unemployment rate can decline in states that are re-opening, alongside a continued decline in cases.

Bottom line: Home loan rates are at all-time lows. Even all of the uncertainty and the sharp decline in Stocks could not push rates another leg lower this week. If you have an opportunity to lock a 30-year mortgage here, you should do so.

A Look Ahead:

Treasury Securities Offered

A never-ending supply of Treasury securities will continue to be offered with this week’s new 20-year Bond on Wednesday as the government starts funding the massive stimulus program.

Congress is also mulling over a Phase 4 relief package that would unleash even more added Bond supply for years to come.

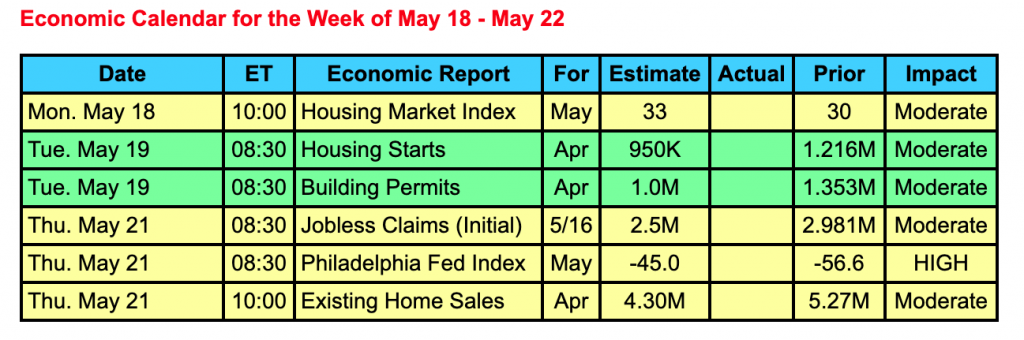

The markets will continue to monitor the U.S. economic landscape for signs of improvement or further signs of deterioration. Economic data will be on the light side, highlighted by housing data and the now closely watched Weekly Initial Jobless Claims.

The Bond markets will close early on Friday at 2:00 p.m. ET ahead of Memorial Day Weekend, the unofficial kickoff to summer.

Reports to Watch:

- Housing data will be seen from Monday’s NAHB Housing Market Index, Tuesday’s Housing Starts and Building Permits, and Thursday’s Existing Home Sales.

- Weekly Initial Jobless Claims and the Philadelphia Fed Index will be delivered on Thursday.

The Mortgage Market Guide View:

The Importance of Dressing Up for Online Meetings

The Importance of Dressing Up for Online Meetings

Working from home has become the new normal for a lot of people, and it’ll continue on this way for a while as work cultures shift to a more digital presence. This means that many of those staff meetings — or even meetings with clients — are now moving online with webcams. While it may be tempting to conduct all of these meetings in your comfy sweats, you should still consider dressing the part anyway.

First, how we dress can actually affect our productivity. When we dress in our more formal work attire, we feel more motivated, authoritative, and competent. We’re basically putting ourselves in the mindset of being “at work,” and our thinking and behaviors change accordingly. We’ve moved out of the “home” mindset and into the “work” mindset.

Other people take us more seriously, too, when we’re wearing a nice button-down and not a coffee-stained T-shirt. Dressing up for video meetings gives us the opportunity to make a good impression, whether it’s with the boss or with a client. It shows that we’re taking them and our work seriously enough to take that extra time out of our day to look crisp and presentable for them. Basically, it instills a greater level of trust in you and your abilities.

Keep this in mind the next time you’re getting ready to hop onto a video call.

Sources: Vogue, Mikogo, LifeHacker

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services, and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors. As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you. Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features, or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.

We are ready to help you find the best possible mortgage solution for your situation. Contact Sheila Siegel at Synergy Financial Group today.