In This Issue…

Last Week in Review: Lock home loans at current all-time low rates

Forecast for the Week: A Look Ahead

The Mortgage Market Guide View: The Importance of Communication With Clients

Last Week in Review:

Lock home loans at current all-time low rates

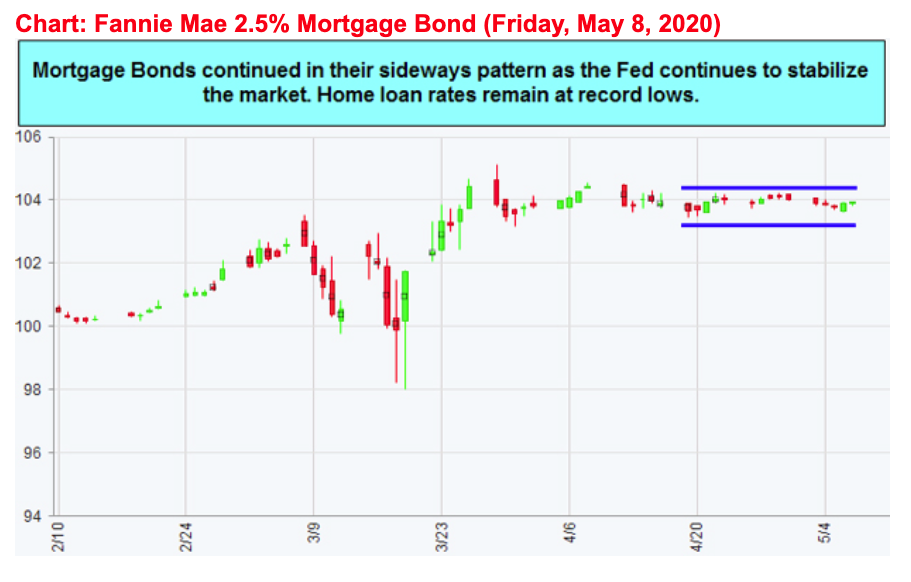

One week after home loan rates failed to improve further in the face of multiple Bond-friendly stories, such as low inflation, high unemployment claims, and the Fed’s continued commitment to purchase Bonds, we watched home loan rates tick up this past week.

Why?

Oversupply. The U.S. Treasury announced they will need to borrow $3 trillion through the third quarter of 2020 to pay for the economic stimulus package related to the coronavirus. In order to “borrow” the $3 trillion, the Treasury will issue a new 20-year Bond that will need to be purchased by investors.

Investors, at the moment, are showing early signs that rates will need to tick higher to meet the buying demand for this enormous new supply of Bonds. Early in the week, the 10-year yield hovered near .60% but ticked higher to .73% during the week and this weighed on mortgage-backed securities, which home loan rates are derived from.

On Friday, the Bureau of Labor Statistics reported that 20,500,000 were unemployed in April, lifting the unemployment rate to 14.7%. It was the worst Jobs Report in the history of the U.S.

Home loan rates didn’t improve in response to the horrible “oversupply” of unemployed shown in the Jobs Report. This is because the markets are forward-looking, and April’s Jobs Report is backward-looking.

Bottom line: The Bond market is more focused on the additional supply of Bonds that will need to be purchased and the cautious optimism seen in reopening parts of the U.S. economy. For this reason, consumers who have an opportunity to lock home loans at current all-time low rates would be wise to do so.

Forecast for the Week:

A Look Ahead

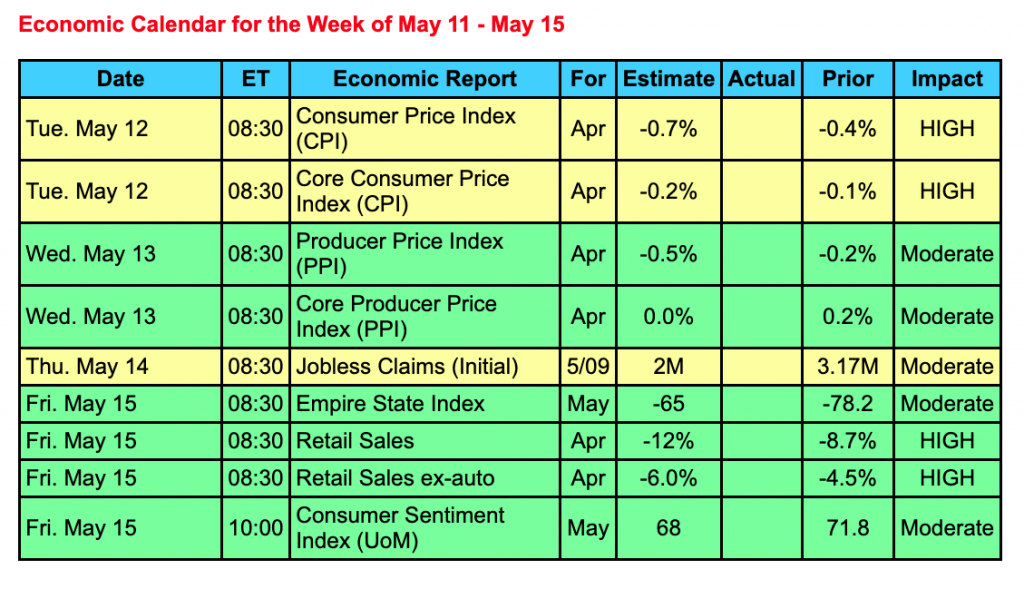

The upcoming week will continue along the same lines, as headlines from the pandemic-induced economic fallout will continue to stream in.

The Bond markets will be up against a huge batch of increased added supply from the Treasury that investors will have to sop up. The Treasury will sell $96 billion in Treasury securities this week, up from $84 billion from a recent similar offering.

A key report this week will measure how the consumer has been holding up during the shutdown. Retail Sales for April will be released this upcoming Friday after the near 9% decline seen in March, which was the worst on record in the data available from the Census Bureau, which dates back to 1992.

The markets will be closely watching if unemployment declines and if coronavirus cases decline as well. If they do during the next couple of weeks, the recent uptick in optimism will be justified.

Another set of data to be watched this week will be the NFIB Small Business Optimism Index for April to gauge the depth of the virus outbreak on the small business sector of the economy, which accounts for 44% of U.S. economic activity. In addition, the JOLTS (Job Openings and Labor Turnover Survey) report will be released for March, which is another set of numbers to measure job openings.

Reports to Watch:

- The inflation reading Consumer Price Index will be released on Tuesday followed by the Producer Price Index on Wednesday.

- The closely watched Weekly Initial Jobless Claims report comes on Thursday.

- Retail Sales, Empire State Manufacturing, and Consumer Sentiment will be delivered on Friday.

The Mortgage Market Guide View:

The Importance of Communication With Clients

Communication is a valuable skill for most people, but none more so than real estate professionals. The most important communication skills to maintain with your clients are quick responses, active listening, and absolute clarity.

Responding as quickly as possible to an email, text message, or phone call will help maintain a solid rapport and long-lasting relationship with your client. One best practice to implement is responding right away even if you don’t have an answer just yet. Another strategy is to set aside a specific time each day to respond to pertinent messages to ensure you’re maintaining communication.

When speaking with clients, make sure you’re listening actively. This means closely processing what they say, repeating back what you heard, and clarifying any discrepancies. If you’re talking with a client in person, consider using positive body language strategies like nodding your head and maintaining eye contact to show you’re listening.

Clarity is essential for real estate professionals. Ensure that your clients understand your expectations and timelines through clear, affirmative communication. Use the restatement strategy after your clients ask or answer questions to be sure all parties understand the information discussed. Don’t be afraid to ask follow-up questions, and encourage your clients to do the same. Your clients will appreciate your thoroughness.

Emphasize your commitment to clear, honest, and reliable communication with your clients through strategic action. Make sure you respond quickly to client queries, truly listen to their questions and concerns, and take the time to ensure everyone understands the information.

Sources: Mashvisor, EAP, CampaignTrack

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors.As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you.Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.

We are ready to help you find the best possible mortgage solution for your situation. Contact Sheila Siegel at Synergy Financial Group today.