In This Issue…

Last Week in Review: Home Loan Rates Rising

Forecast for the Week: Coronavirus and Extreme Volatility

The Mortgage Market Guide View: 3 Tech Trends Changing the Real Estate Industry

Last Week in Review:

Home Loan Rates Rising

This past week, home loan rates ticked up again despite the Fed recently cutting rates by a full point and the 10-year Note remaining just above 1%.

Why?

Mortgage backed securities (MBS) are Bonds that price home loan rates. This week, the spread or difference in yield between the 10-year Note and MBS spiked to the highest level in decades. This means that despite the record low yield in Treasuries, home loan rates continue to rise.

This has to do with MBS investors having less of an appetite for MBS, given the uncertainty of the current economic environment. The only way you can attract investors to buy MBS is by increasing the interest rate or yield to the investor. We are seeing this today.

Also, there is a reality that $1T in Bonds will be coming to the Bond market in the near future to pay for the economic stimulus package in order to help the economy during and after this coronavirus crisis. That huge amount of new Bond supply dilutes the Bond market and pressures prices lower and rates higher.

We may not see a more natural interest rate spread between Treasuries and MBS until we get past the worst of the coronavirus and its economic impact. Until then, expect more price and rate volatility.

Bottom line: home loan rates remain very close to the best levels ever, and with the Fed buying MBS for the foreseeable future, we are not expecting home loan rates to go too high any time soon.

If you or someone you know has questions about home loans, give me a call. I‘d be happy to help.

Forecast for the Week:

Coronavirus and Extreme Volatility

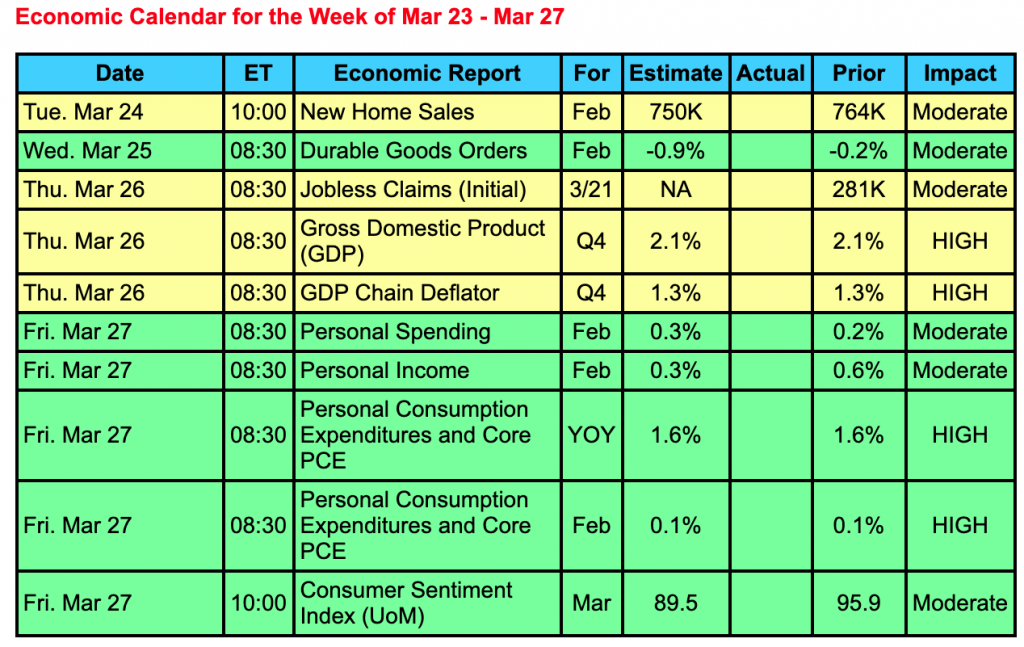

The upcoming week will be primarily focused on the continued fallout from the coronavirus, after we saw jobless claims spike last week, while a key regional manufacturing report saw its worst reading since 2009.

Investors will be looking for a bottom in Stocks while also looking for an end to the declining prices for Mortgage Bonds.

Mortgage rates jumped last week, though they remain just above historic lows. The increase in rates was due in part to lenders increasing prices to help manage skyrocketing refinance demand, reported Freddie Mac.

Extreme volatility will continue as the markets deal with the coronavirus, central bank intervention, along with massive government stimulus plans.

The Mortgage Market Guide View:

3 Tech Trends Changing the Real Estate Industry

In the real estate market, certain factors are always more critical than others. These include interest rates, demographics, government subsidies, and the overall state of the economy. In recent times, however, technology has also proven to be an influential factor in real estate. More specifically, certain technological trends are affecting the way that the real estate market attracts business. Some of these developments are discussed below.

Business automation: In today’s market, even real estate professionals who are on the go are expected to reply to inquiries in a prompt manner, and this is exactly what business automation can help you with. Now you can immediately reply to text or email messages sent to you by prospective clients.

Virtual reality: Today’s real estate clients want to be able to walk through properties from their own office or home. That means they can readily get intimate with the space even if they’re not physically present. This feature is certainly helpful in attracting long-distance clientele.

Collaborative tools: These days, a lot of things can be electronic, including the contracts that you ask your client to review and sign. In addition, collaborative platforms such as video calls allow for face-to-face communication.

Keep these trends in mind when planning your real estate business’s marketing strategies. Remember that technology can help you grow your client reach without having to accrue unreasonable costs. More importantly, it can also make you more engaging and attractive to prospective clients.

Sources: Investopedia, Fortune Builders

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors.As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you.Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.

We are ready to help you find the best possible mortgage solution for your situation. Contact Sheila Siegel at Synergy Financial Group today.