In This Issue…

Last Week in Review: Rate Movements Explained

Forecast for the Week: Here Comes the Fed

The Mortgage Market Guide View: What Not to Do on Social Media

Last Week in Review:

Rate Movements Explained

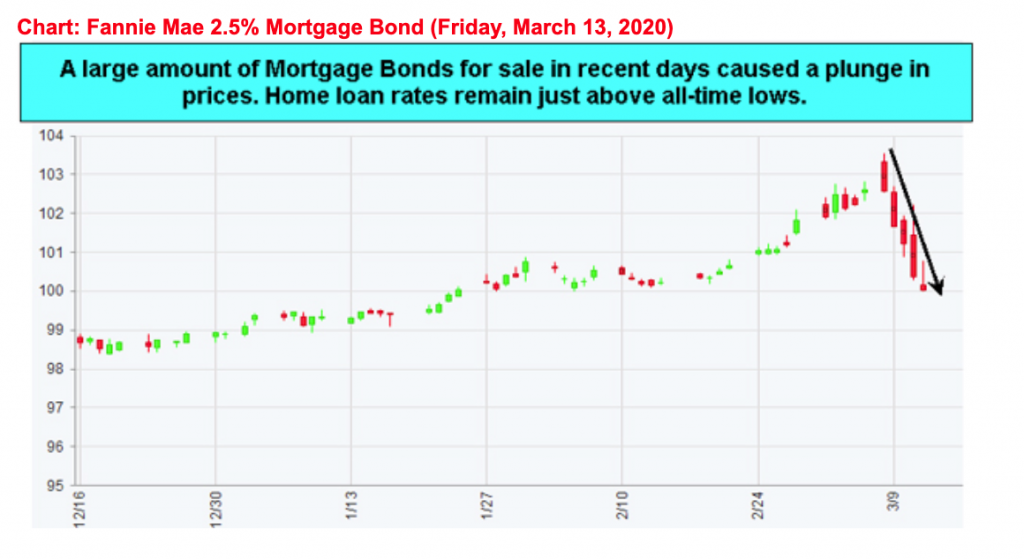

This past week was a head-scratcher as home loan ticked up slightly week over week despite the 10-year Note yield hitting a historic low of 0.31% and Stocks enduring heavy losses. Typically, when Stocks drop, so do rates — especially after historic Stock losses like those this past week.

So, what happened?

Home loan rates are determined on the pricing of mortgage backed securities. Due to all of the recent refinance activity as a result of the low rates, the Bond market was flooded with an enormous supply of Mortgage Bonds.

When additional supply comes into any market, prices can move lower, and that is what we saw last Monday as mortgage backed securities touched a six-year price high and started to reverse lower.

Once Mortgage Bonds started to drop in price, thereby increasing rates, something very interesting happened. The sell-off in Mortgage Bonds really gained steam causing a further bump up in rates.

Why did mortgage backed securities drop so fast?

Mortgage backed securities carry prepayment or refinance risk, which limits how fast rates drop when they are dropping. The opposite is also true. This means when rates start to rise, the prepayment or refinance risk goes away causing a sharp move lower in prices and higher in rate.

Bottom line: home loan rates remain within a whisker of the best levels seen earlier in the week. And there is an old saying, “the cure for higher rates, is higher rates,” meaning at some point as prices drop and interest rates tick up, investors will buy Mortgage Bonds and stabilize interest rates.

If you or someone you know has questions about home loans, give me a call. I’d be happy to help.

Forecast for the Week:

Here Comes the Fed

The coronavirus fears will continue to impact the U.S. financial markets and its uncertain economic impact will continue to cast a cloud for some time. Extreme volatility in the markets will also remain until we can see some containment of the virus or some certainty.

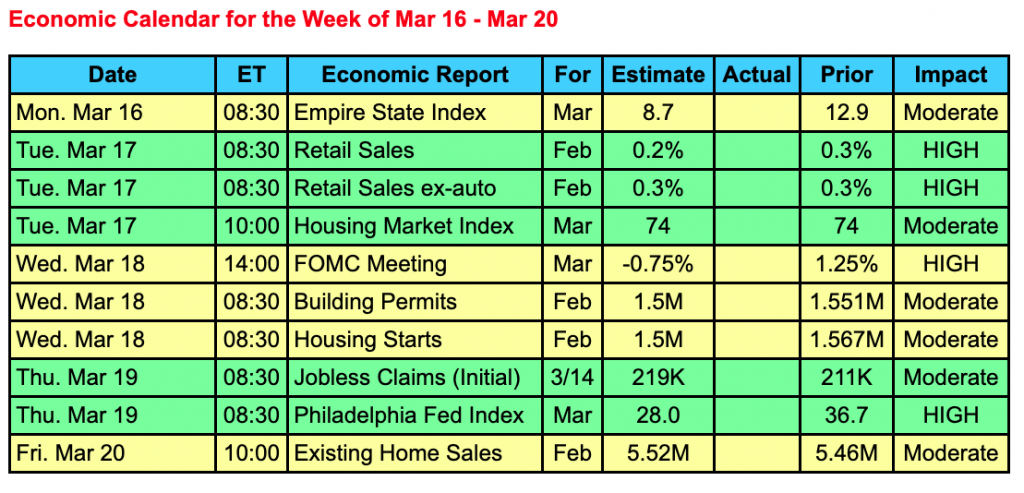

The Federal Reserve cut rates last week in an emergency meeting and then injected further liquidity into the financial system on Thursday. That came ahead of this week’s two-day Fed meeting that kicks off on Tuesday and ends Wednesday with the Monetary Policy Statement being released at 2:00 p.m. ET. We are expecting at least a 75-basis point cut to the short-term Fed Funds Rate and it could even be steeper than that… possibly a 100-basis point cut.

Another enormous potential market mover is what the Fed says in the monetary statement on Wednesday, such as additional measures to try and stimulate the economy.

The economic calendar is packed with key reports this week, but all data will take a backseat to the Fed and the headlines surrounding the coronavirus.

The Mortgage Market Guide View:

What Not to Do on Social Media

Social media is one of the best ways to reach potential clients and build a solid reputation. However, it’s important to understand the social media marketing do’s and don’ts in order to avoid a major faux pas that could put your business at risk.

One of the biggest mistakes you can make on social media is blurring the lines between professional and personal matters. Avoid complaining or oversharing on social media. Things like your political views, personal struggles, or grievances about a competitor shouldn’t be featured on business accounts. Maintain separate, private accounts for all things personal.

Hashtags are another tool that can help or hinder your business on social media. Make sure every hashtag you use is appropriate in order to increase your visibility online. Avoid going overboard with #too #many #hashtags in the text or at the end of your posts. This creates a spammy appearance that turns clients off.

Speaking of spam, don’t overdo it when it comes to posting. If your followers’ feeds are inundated by multiple posts from you each day, they’re likely to unfollow you. Similarly, make sure your posts are unique and authentic. Share a mix of client success stories, home listings, and helpful advice with your promotional posts to keep your followers interested.

Once you’re ready to get started, create a social media marketing plan and set up a system for tracking the success of each post. If you go in with a good strategy, it will be much easier to reach your target audience.

Use social media to your advantage by steering clear of these social media marketing mistakes.

Sources: Outbound Engine, The Balance Small Business, Digital Marketing Institute

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors.As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you.Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.

We are ready to help you find the best possible mortgage solution for your situation. Contact Sheila Siegel at Synergy Financial Group today.