In This Issue…

Last Week in Review: So Much Good News

Forecast for the Week: Back to Fundamentals

The Mortgage Market Guide View: Organization Tips for the New Year

Last Week in Review:

So Much Good News

This past week was filled with so much good news. The biggest of which was the signing of Phase One of the U.S. and China trade pact.

This trade deal is a very positive development for the U.S., China, and the world, and paves the way for future business investment and other trade deals around the globe. This also removed what was a big uncertainty for many months.

The economic data was already amazing with the following reports coming in better than expectations:

- Small Business

- Retail Sales

- Philly Fed Index

- Initial Jobless Claims

And speaking of better than expectations, we also watched the start of corporate earnings season and most of the big banks handily beat expectations.

All of this good news has pushed Stocks to all-time highs, but at the same time Mortgage Bonds and home loan rates remained right at the best levels in three years… remarkable.

Bottom line: the U.S. economy remains quite strong with zero chance of a recession anytime soon, yet at the same time home loan rates have not moved higher, giving many an incredible opportunity to purchase or refinance a home.

If you or someone you know has questions about home loans, give me a call. I’d be happy to help.

Forecast for the Week:

Back to Fundamentals

With the U.S.-China Phase One trade pact having been signed this past week, the financial markets will get back to what will drive the trading activity in the days and weeks ahead, earnings season.

A slew of earnings reports will be released this week which will directly impact Stocks, Bonds, and home loan rates. If the numbers continue to stream in positive, it could push Bond prices lower, and rates higher. The opposite is also true.

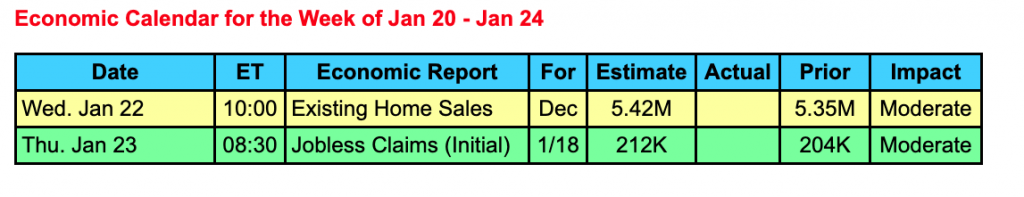

Economic data will be extremely light with just Existing Home Sales and Weekly Initial Jobless Claims being released, so the focus will be on the earnings data.

All U.S. financial markets are closed on Monday in observance of Martin Luther King Jr. Day.

The Mortgage Market Guide View:

Organization Tips for the New Year

It’s a new year and many working professionals make a resolution to get more organized in the workplace. While this may seem like a good goal, many tips for getting organized are either too simple, unattainable, or focused on your domestic situation. Let’s look at five ways to use technology and tips to help you stick to your New Year’s resolution to be more organized.

- Digital calendar. A calendar is essential for staying organized. Choose one that you can share with other people and can color code for visual reference to differentiate tasks and clients. Set alarms that alert you to upcoming tasks, meetings, deadlines, and appointments.

- Digital planner. Choose a planner that allows you to take notes and have them sync with all of your devices.

- Email organizer. Create mailboxes, filters, and special alert notifications for different mailboxes. Set up spam and junk filters.

- Cloud-based document sharing. If you work with a team on projects, sharing documents digitally that everyone (or select team members) can edit and comment on can save an enormous amount of time. Color code each person’s comments so you can easily reference them.

- Social media scheduler. If your business is on several social media platforms, use a single app to schedule all of your posts, photos, and videos.

Using apps and software is a great way to help you stay organized in the workplace.

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors.As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you.Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose. Feature photo by Lora Ohanessian.

We are ready to help you find the best possible mortgage solution for your situation. Contact Sheila Siegel at Synergy Financial Group today.