In This Issue…

Last Week in Review: Nice Start to 2020

Forecast for the Week: A Look at Jobs

View: How to Stop or Block Unwanted Robocalls

Last Week in Review:

Nice Start to 2020

The new year and new decade started, and good news, some things don’t change. Stocks picked up right where they left off in 2019 by touching all-time highs. And Bonds, which also performed well in 2019, continue to hover near three-year highs, keeping home loan rates near 3-year lows.

Many are wondering how the economy and markets will perform in 2020. So, for that reason, here are 3 trends to follow:

Don’t fight the Fed. As the saying goes, there doesn’t appear to be any chance of a Fed rate hike in 2020. The economy is strong, but not too strong. Plus, the Fed is fighting disinflation, so a rate hike would counter those efforts. Moreover, it’s a presidential election year and the Fed has historically tried it’s best to avoid any monetary policy moves in those years. Bottom line: good for Stocks and less good for Bonds.

Stock gains. Post-World War II, Stocks on average have gained 10.1% in presidential election years where the incumbent is up for re-election. It’s tough to fight that trend, even with Stocks soaring in 2019. Bottom line: Stocks are set to finish 2020 higher.

$1,000,000,000,000. That was what the U.S. spent in holiday retail shopping in 2019. That massive record highlights the strength of the U.S. consumer who makes up 70% of the U.S. economy. Bottom line: there is no recession in sight, great news for housing and the overall economy.

Bottom line: absent of a Black Swan event or unforeseen negative surprise, 2020 is shaping up to be a great year for housing and the U.S. economy, with the labor market strong, wages rising, inflation muted, and interest rates low.

If you or someone you know has questions about home loans, give me a call. I’d be happy to help.

Forecast for the Week:

A Look at Jobs

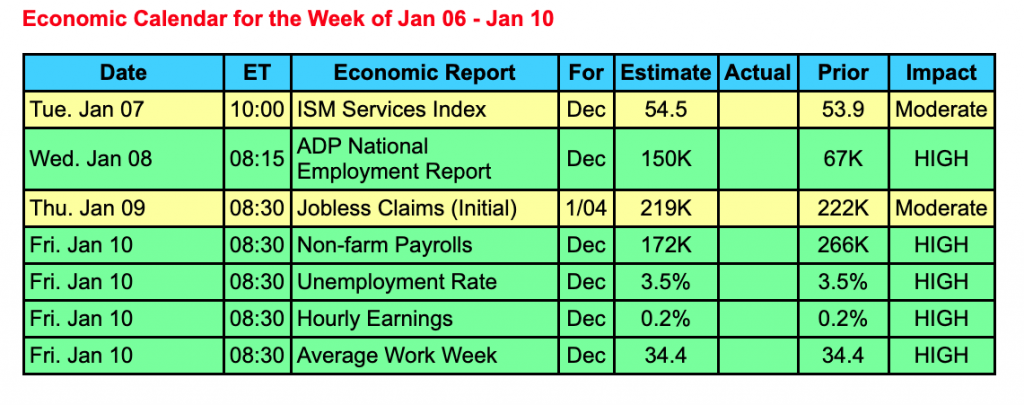

This first full trading week of the new decade will be a little light on economic reports.

However, two key labor market reports will be released and could be big market movers.

The ADP Private Payrolls gives us a read on private job creations, while Friday brings the government’s official Jobs Report.

The labor market remains one of the bright lights in the U.S. economy, with the unemployment rate at 50-year lows coupled with rising wages.

The markets will also keep one eye on the U.S.-China trade headlines along with any stimulus headlines from global central banks.

Reports to watch:

- The ISM Service Index will be reported on Tuesday.

- ADP Private Payrolls will be released on Wednesday followed by the government Jobs Report on Friday that includes Non-Farm Payroll, the Unemployment Rate, and Hourly Earnings.

- Weekly Initial Jobless Claims will be delivered on Thursday.

The Mortgage Market Guide View…

How to Stop or Block Unwanted Robocalls

Robocalls, or unwanted phone calls, are not only a nuisance and distraction, but they’re also aggravating. The Federal Communication Commission (FCC) says that spoof calls and robocalls are one of a phone users’ biggest complaints. Let’s look at a few ways you can prevent, or at least reduce those unwanted calls that disrupt your life.

- Don’t answer phone calls from an unknown number. Put your important contacts on your phone with a name so you can decide if you want to answer the call or not. If the unknown caller has an important message, they can leave a voicemail.

- Don’t give out important personal information. If you do answer a call and the person is reportedly from the IRS, Social Security office, or a financial institution asking for social security numbers or banking information, never give this information out.

- Call the number back. If the person claims they work for a company, hang up the phone and call the number back to see if it’s a legitimate number and business.

- Download robocall blocking apps. Most cell phone carriers have an app that you can download that either blocks spam calls or labels them suspicious.

- Sign up for the Do Not Call list. The Federal Trade Commission (FTC) has a process where you can sign up to stop receiving unwanted telemarketing calls. While these don’t stop robocalls, at least you won’t get telemarketers calling you as soon as you sit down to dinner.

Robocalls and spam calls are technically illegal, and the FCC is working to combat this issue.

Sources: FCC, Wired.com

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors.As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you.Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.

We are ready to help you find the best possible mortgage solution for your situation. Contact Sheila Siegel at Synergy Financial Group today.