In This Issue…

Last Week in Review: Goldilocks 2.0

Forecast for the Week: Key inflation data on tap

View: 5 Ways to Have a Mindful Holiday Season

Last Week in Review:

Goldilocks 2.0

“Let the Good times roll” … The Cars

“Let the Good times roll” … The Cars

As we enter the final weeks of 2019, the housing and home lending sectors have enjoyed a good year thanks to a “Goldilocks” scenario of a tight labor market, rising wages, consumer confidence, and three-year low interest rates.

Many are asking “What should we expect for housing, and thus lending, as we enter 2020?” The answer: 2020 may even be better for both.

Tailwinds for Housing in 2020 include:

- Housing starts of single-family homes are expected to hit the 1M mark for the first time in 12 years. This should help add to much-needed inventory in many parts of the country.

- In the final Jobs Report for 2019, which was November, the unemployment rate ticked down to 3.5%, a 50+-year low, while we created a massive 266,000 new jobs. Jobs buy homes, not rates. This kind of labor market strength heading into 2020 should further boost the housing sector.

- The Fed is not likely going to cut or hike rates in 2020, unless new economic threats emerge – meaning short-term interest rates are not likely to move much, if at all.

- Inflation remains low. Inflation is the main driver of long-term rates like mortgage rates. In the absence of any unforeseen pickup in inflation, home loan rates should remain relatively close to current levels for the foreseeable future.

Bottom line: 2019 was a good year and the data suggests the good times should continue well into the spring of 2020 making it a historic opportunity to have both a strong economy and low rates.

If you or someone you know has questions about home loans, give me a call. I’d be happy to help.

Forecast for the Week:

Key inflation data on tap

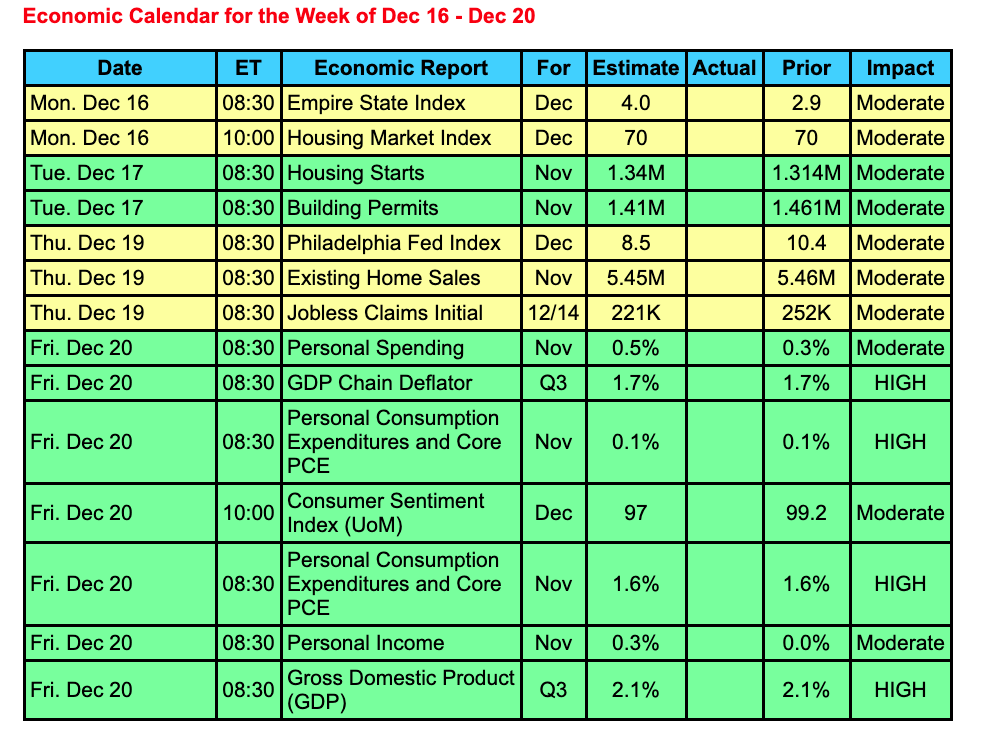

This coming week will be the last full trading week for 2019.

This means we may see trading volumes decline which could cause some market volatility should a surprise new item hit the wires.

The week will bring the Fed’s favorite inflation gauge, the core PCE, which has been running below the Fed’s target of 2.0%, currently running at 1.6%. The Fed stated last week that the core PCE will continue near current levels into 2020. That’s good news for home loan rates going forward.

The markets will also receive data from the housing sector, manufacturing, consumer sentiment and the final reading on Q3 GDP.

The main topic, U.S.-China trade issues will linger in the backdrop and potentially have a market effect as holiday trading volumes thin.

Reports to watch:

Manufacturing data will come from Monday’s Empire State Index and Thursday’s release of the Philadelphia Fed Index.

The NAHB Housing Market Index will be released on Monday, with housing starts and building permits on Tuesday followed by existing home sales on Thursday.

The core PCE, personal income and spending, GDP, and consumer sentiment will be released on Friday.

The Mortgage Market Guide View:

5 Ways to Have a Mindful Holiday Season

It’s officially the holiday season, and your list of tasks around this time of year is often overwhelming. The holidays are about appreciating family and friends, as well as honoring tradition, so it’s important that you make time to have a meaningful holiday season with minimal stress. Here are five tips on having a wonderful holiday season.

- Don’t overspend. While you may feel pressured into buying a certain gift, think about whether the person really needs it and if you can realistically afford the item.

- Stick to an exercise routine. The days are short during the holiday season, and you have the added burden of shopping, traveling, etc. You need to take care of yourself, so you don’t get sick or burned out. Take time to exercise daily.

- Don’t overindulge in holiday foods and beverages. All those wonderful cookies, candies, and treats seem tempting, but too much sugar and alcohol can tax your system. Just like you would throughout the rest of the year, practice moderation.

- Play holiday music. When appropriate, play festive songs and music that make you feel happy or nostalgic, especially when baking, wrapping presents, or writing holiday cards.

- Volunteer. There is something rewarding about giving back during the holidays. Volunteer at a kitchen that feeds those less fortunate than you, visit senior citizens, or volunteer at the local pet shelter. Your heart will fill with pride at bringing a touch of warmth and happiness to someone else.

Find something that personally resonates with you to have a less stressful and more mindful holiday season.

Sources: The Glitter Guide, How Stuff Works

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors.As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you.Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose. Feature photo by Lora Ohanessian.

We are ready to help you find the best possible mortgage solution for your situation. Contact Sheila Siegel at Synergy Financial Group today.