In This Issue…

Last Week in Review: Changes That Could Affect Rates

Forecast for the Week: It’s Fed Week

View: Three Home Automation Devices To Make Life Easier

Last Week in Review:

Changes That Could Affect Rates

There are rumors that our Fed is considering an idea to abandon its present 2% target rate for inflation in favor of a floating target where inflation would be allowed to rise above 2% for some time before considering hiking rates.

This comes with two consequences that mortgage lenders, Realtors, and would-be borrowers need to understand:

- If the Fed allows inflation to rise north of 2% before considering hiking rates, we are not likely to see a Fed rate hike anytime soon. This is because inflation is currently running at 1.6% and well beneath the Fed’s current target.

- If the Fed is successful in allowing inflation to rise, home loan rates will rise as well. Inflation is the main driver of long-term interest rates.

When the Fed says they want inflation to reach its 2% target, they are talking about the Core Personal Consumption Expenditure (PCE) year-over-year figure.

The Core PCE Index is typically delivered the third week of every month, and will be even more important to track should the Fed make changes to its current policy and decide to allow inflation to rise above its longstanding 2% target.

Bottom line: inflation currently remains tepid and is the major reason why long-term rates, like home loans, remain near three-year lows. If inflation rises, home loan rates will rise. The opposite is also true.

If you or someone you know has questions about home loans, give me a call. I’d be happy to help.

Forecast for the Week:

It’s Fed Week

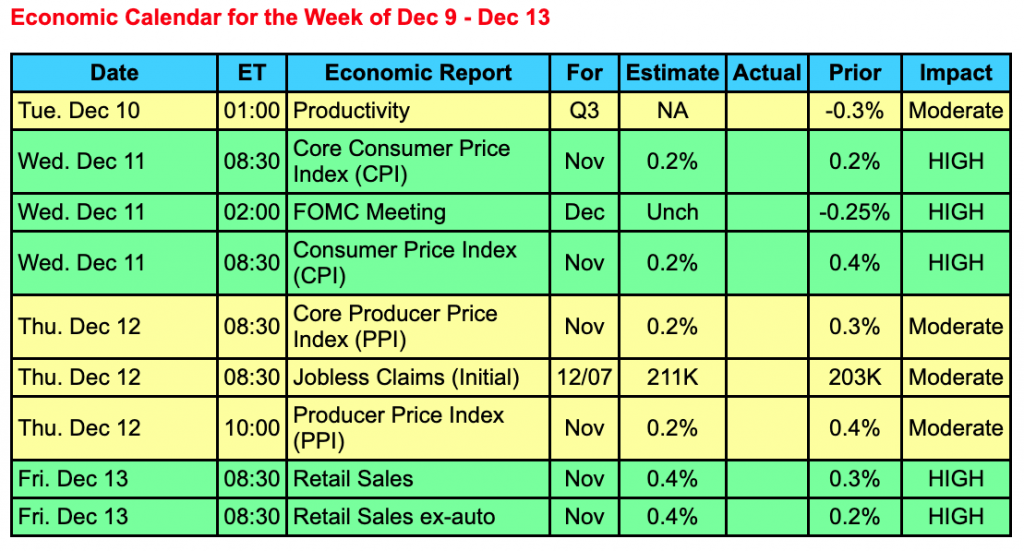

The upcoming week will be centered around the two-day Fed meeting which kicks off on Tuesday, and ends with the release of the Monetary Policy Statement on Wednesday at 2:00 p.m. ET. The Fed will also release a set of economic projections with the statement while Fed Chair Powell will hold a press conference at 2:30 p.m. ET.

There is a zero percent chance of a change in the short-term Fed Funds Rate at this meeting. What Mr. Powell has to say could impact Bond prices and rates, but the market feels that the Fed Chair will choose his words carefully as to not overly disrupt the markets.

The week will also feature inflation data from both the Consumer Price Index (CPI) and Producer Price Index (PPI). As mentioned, the Fed has recently reported that in 2020 it may raise its target range for inflation from 2% to possibly 2.5%, which means consumer inflation readings will be more important to track. Note, the Fed’s preferred measure of consumer inflation is the Core PCE and not the CPI measure.

Consumer spending will also be in the spotlight in the form of Retail Sales for November. The consumer has been carrying the U.S. economy. We shall see if it continues, leading up to this record holiday shopping season.

Finally, the markets will continue to be gripped by the back-and-forth headlines from the U.S./China trade issues.

Reports to watch:

- Productivity for the third quarter will be released on Tuesday.

- On Wednesday, the inflation reading Consumer Price Index will be reported, followed by the Producer Price Index Thursday.

- A key consumer spending report in Retail Sales will be delivered on Friday.

The Mortgage Market Guide View:

Three Home Automation Devices To Make Life Easier

Home automation is taking the world by storm, and it is important to understand how adding smart technology can make your life easier. Smart technology learns occupants’ behaviors, is programmable, works remotely, and allows several home systems to be controlled by one central system. Let’s look at three types of home automation devices that make your life easier.

- Robotic floor cleaners. Sweeping, mopping, and vacuuming take up an enormous amount of work. Robotic floor cleaners have been around for some time, however, modern ones are sensitive to people and pets and won’t bump into them. They can be programed with scheduling apps, and you can control them remotely. Plus, robotic floor cleaners get to those hard-to-reach places.

- Smart lighting. Have you ever wished you could schedule your lights to brighten and dim remotely? Or, having noise-controlled lights that turn on and off with voice commands? These are just a couple of features that smart lighting provides. You can control specific light bulbs remotely with smart lighting, have bulbs that change colors, set the lighting for vacation-mode, and have lights that respond to motion.

- Voice-controlled home automation. Devices such as Alexa and Amazon Echo can control your lights, smart television, HVAC system, music, or even order takeout dinner for you. Some bathroom systems even work with voice-controlled devices to run your bath for you at just the right temperature, so it is ready when you walk in the door.

There are loads of innovative home automation devices using smart technology available, you just need to decide which one works best for your lifestyle.

Sources: Smart Home, Simplicable, AHS

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors.As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you.Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose. Feature photo by Lora Ohanessian.

We are ready to help you find the best possible mortgage solution for your situation. Contact Sheila Siegel at Synergy Financial Group today.