In This Issue…

Last Week in Review: A Great Housing Backdrop

Forecast for the Week: A Thankful and Action-Packed Week

View: Tips to Boost Real Estate Business With Apps

Last Week in Review:

A Great Housing Backdrop

“It’s getting better all the time” — Getting Better by The Beatles

“It’s getting better all the time” — Getting Better by The Beatles

That famous line describes the current wonderful backdrop for housing and the overall U.S. economy. Many are wondering what lies ahead for housing as we enter 2020.

There are many reasons why the U.S. housing sector should do well for the foreseeable future, but here’s three main reasons for the bright outlook:

- Housing Starts are improving. This is especially true for single-family homes, which have risen for five consecutive months. This trend suggests anticipated buying demand.

- The labor market remains strong. Rates don’t buy homes, jobs do. 50+ year low unemployment at 3.6%, coupled with rising wages makes for a wonderful housing backdrop.

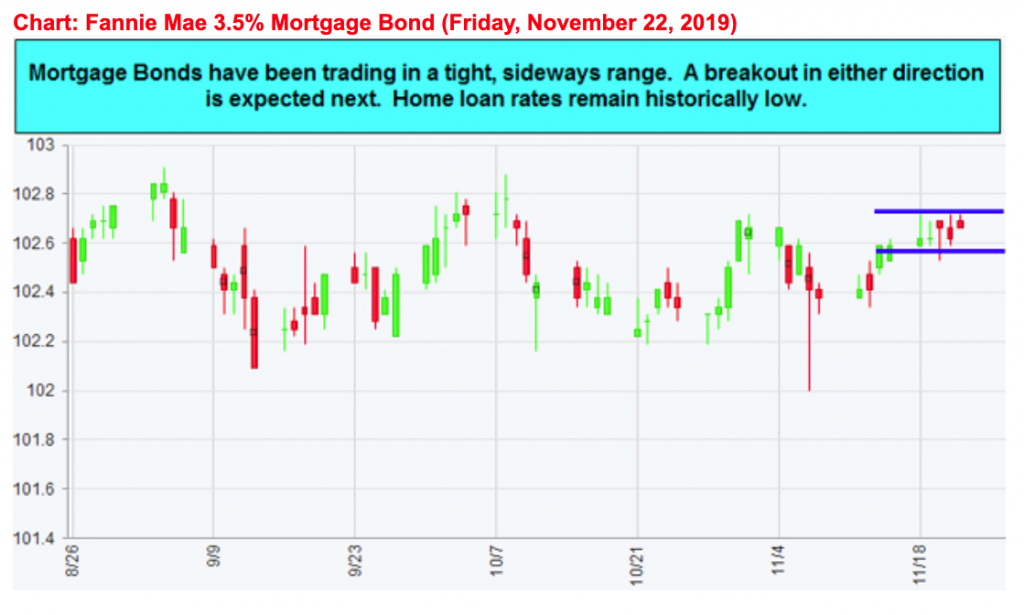

- Low home loan rates for longer than most expect. Rates don’t buy homes, but they definitely help more people participate in buying a home. With inflation running beneath the Fed target of 2.00% for the foreseeable future, there should be no upward pressure on home loan rates.

Bottom line: there is no recession in sight. The backdrop for housing is more of a Goldilocks scenario and makes for a wonderful time to purchase a home.

If you or someone you know has questions about home loans, give me a call. I’d be happy to help.

Forecast for the Week:

A Thankful and Action-Packed Week

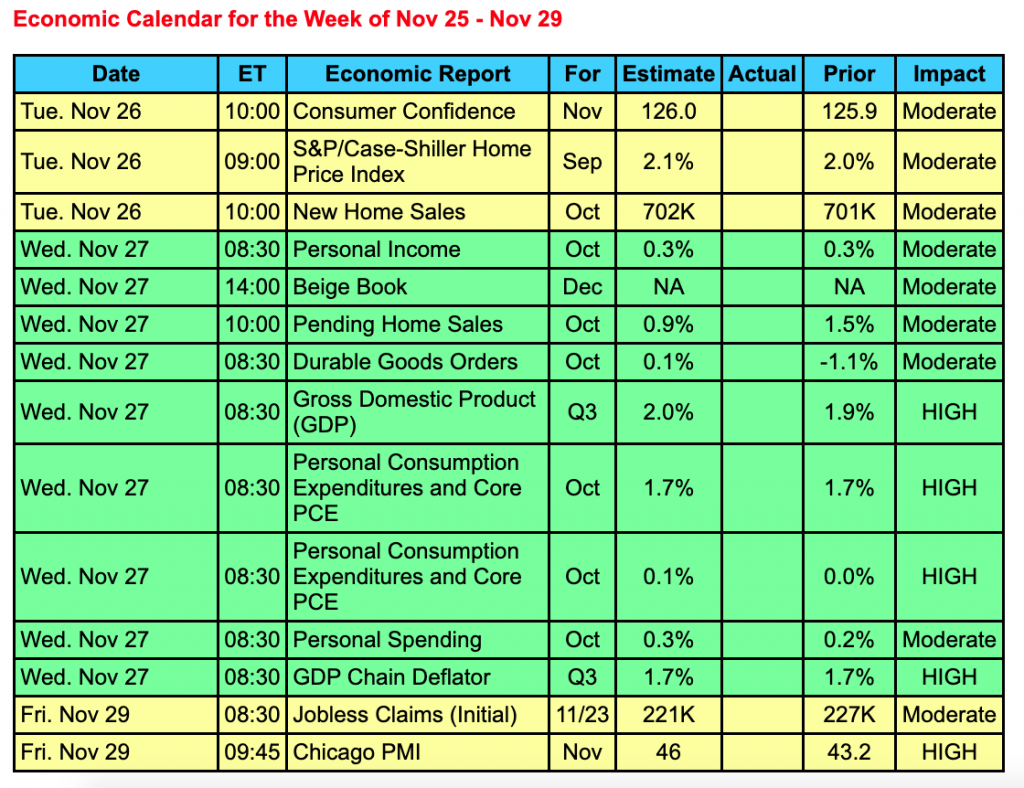

The upcoming week is long on economic data, despite the Thanksgiving holiday on Thursday, and an abbreviated session on Friday.

All U.S. markets are closed on Thursday for Thanksgiving. On Friday, the Bond markets close at 2:00 p.m. ET while Stocks close at 1:00 p.m. ET.

All eyes will be on the inflation numbers from the Core PCE, the Fed’s favorite inflation gauge. Inflation has been running low and should continue to run low for the foreseeable future.

Investors will also receive data from the housing sector, manufacturing, consumer confidence, and spending, along with GDP data.

Reports to watch:

- Housing data will be seen from Tuesday’s S&P Case-Shiller Home Price Index and New Home Sales, followed by Pending Home Sales on Wednesday.

- Consumer Confidence will be released on Tuesday and has been running just beneath all-time high levels.

- Wednesday brings the Q3 2019 second read on Gross Domestic Product, Personal Income and Spending, Weekly Claims, Durable Orders, and the Core PCE.

- On Friday, the Chicago PMI (manufacturing) report will be released.

The Mortgage Market Guide View…

Tips to Boost Real Estate Business With Apps

The real estate business is rapidly changing, thanks to technology that allows homebuyers to see photos, floor plans, and even virtual tours long before they schedule a showing or set foot in a house. Make sure you’re making the best use of modern technology and incorporate some handy apps into your business activities.

You can go paperless with your essential documents. Organizing all the papers associated with real estate transactions is no small task. Turn to apps like Dotloop or DocuSign that allow you to share papers, collect signatures, and stay organized paper-free. This will keep your own desk neater while also simplifying things for your clients.

Create floor plans using an app like Magicplan. This lets you put together a simple floor plan using the home’s dimensions, and pull in images of common pieces of furniture like a bed or couch. This makes it easier for your clients to imagine how their belongings might fit in a home, particularly if it’s not being staged with furniture.

Keep a selection of popular real estate apps on your phone for comparisons, finding new homes, or updating the listing for a house you’re managing. Trulia and Realtor are top contenders, though there are others as well. Keep a finger to the pulse of the industry so you can quickly clue into new apps that are gaining a solid following among potential homebuyers.

With a handy selection of apps at your disposal, you can use technology to boost your real estate business.

Sources: Zapier, Hubstaff, The Balance

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors.As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you.Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose. Feature photo by Lora Ohanessian.

We are ready to help you find the best possible mortgage solution for your situation. Contact Sheila Siegel at Synergy Financial Group today.