In This Issue…

Last Week in Review: The Definition of Goldilocks

Forecast for the Week: A Look Into Housing

View: Tips for Hosting a Stress-Free Thanksgiving

Last Week in Review:

The Definition of Goldilocks

“Looking ahead, my colleagues and I see a sustained expansion of economic activity, a strong labor market, and inflation near our symmetric 2% objective as most likely.”

“Looking ahead, my colleagues and I see a sustained expansion of economic activity, a strong labor market, and inflation near our symmetric 2% objective as most likely.”

— Fed Chairman Jerome Powell, 11/13/2019

This quote from our Fed Chair on Capitol Hill this past week was the definition of a “Goldilocks Economy” and reaffirmed the markets that there is no recession in sight!

Thanks to this strong economic backdrop, Mr. Powell also said it’s highly unlikely the Fed will cut rates again in December. Remember, Fed rate cuts don’t affect home loan rates, so don’t expect a sharp uptick in mortgage rates. Why?

As the Fed’s quote states, inflation remains low and near the Fed’s target. If inflation moves higher, home loan rates move higher. The opposite is also true.

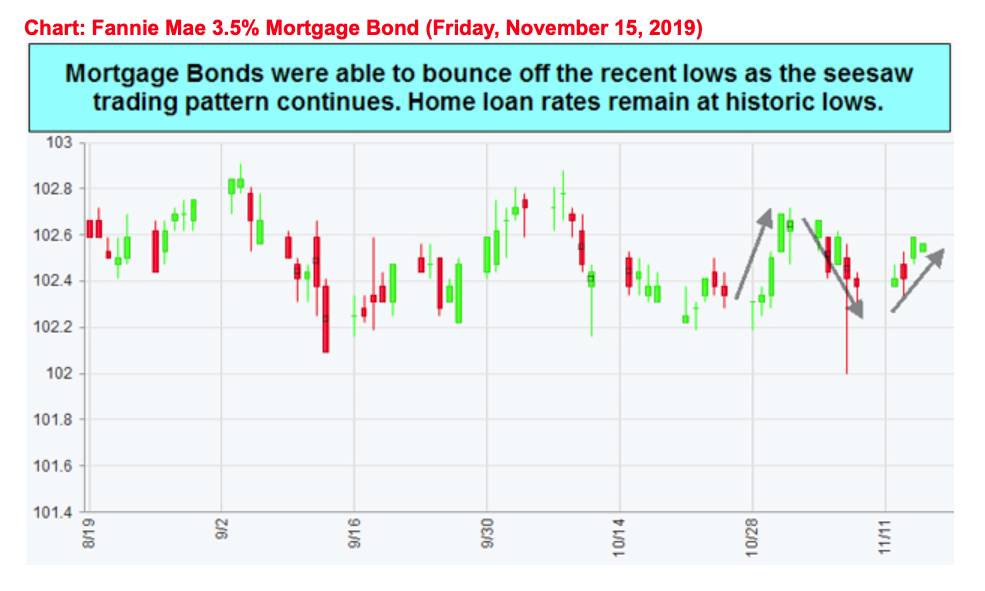

Bottom line: home loan rates improved from the worst levels of the week and head into mid-November still hovering near three-year lows. What an opportunity when coupled with the Goldilocks backdrop.

If you or someone you know has questions about home loans, give me a call. I’d be happy to help.

Forecast for the Week:

A Look Into Housing

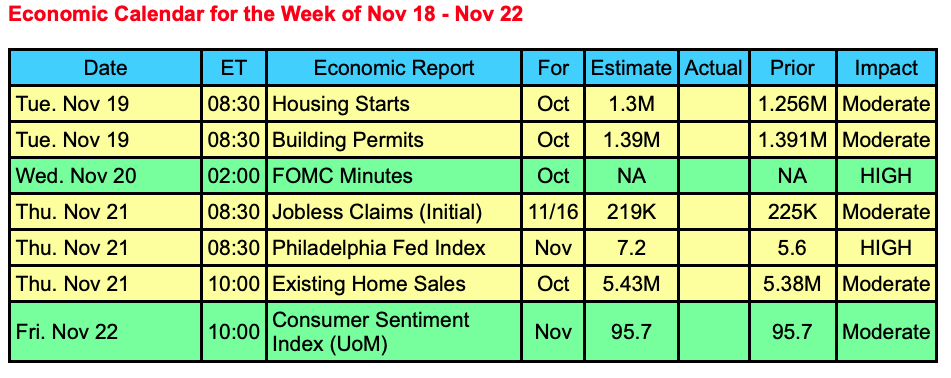

The upcoming week’s economic calendar will highlight the housing sector which has been gaining momentum in this “Goldilocks Economy” due in part to a strong labor market, rising wages, and historically low home loan rates.

With earnings season winding down, investors will continue to be trapped in the trade headlines from the U.S. and China as a “phase one” signing is expected to happen in the coming weeks.

Reports to watch:

From the housing sector, Housing Starts and Building Permits will be released on Tuesday, followed by Existing Home Sales on Thursday.

The Philadelphia Fed’s Manufacturing Index will be delivered on Thursday and will garner some attention.

On Friday, Consumer Sentiment will be released.

The Mortgage Market Guide View…

Tips for Hosting a Stress-Free Thanksgiving

As a busy, working professional, trying to host a holiday party often feels like an overwhelming burden. Don’t stress! Follow these handy tips so you can happily host a Thanksgiving or holiday party and still find a balance between work and family.

- Shop early. Don’t wait until the last moments to shop. There are lots of people in the stores doing the same thing, and you may not find the items you’re looking for.

- Prep ahead of time. Throughout the week leading up to the party, prep and store as much food as possible.

Stick with familiar recipes. If you’re busy, you won’t have time to experiment with creative recipes. Instead, use the ones that you are familiar with so you don’t have to overthink the ingredients and preparation of the dishes. - Buy pre-made appetizers and desserts. The star of a holiday meal isn’t in the appetizers or desserts — it’s the main meal, so save your energy for that. You can also ask people to bring an appetizer or dessert.

Have your dishes and cutlery ready. Before the party, pull out all the dishes, serving bowls, cutlery, etc. Clean and organize them, and have them ready to go so you aren’t scrambling last-minute to find the serving spoons. - Set up stations. Have an area for drinks, trash and recycling bins, and even consider having a buffet set up so people can serve themselves.

- Hire a housecleaner. Having help cleaning before and after the party will save you an enormous amount of time and energy.

Follow these tips and enjoy the holidays!

Sources: The Kitchn, The Spruce Eats, Cooking Light

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors.As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you.Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose. Feature photo by Lora Ohanessian.

We are ready to help you find the best possible mortgage solution for your situation. Contact Sheila Siegel at Synergy Financial Group today.