In This Issue…

Last Week in Review: What the Market Is Saying

Forecast for the Week: Holiday-Shortened Week Focused on Housing Data

The Mortgage Market Guide View: How to Stay Healthy During Flu Season

Last Week in Review:

What the Market Is Saying

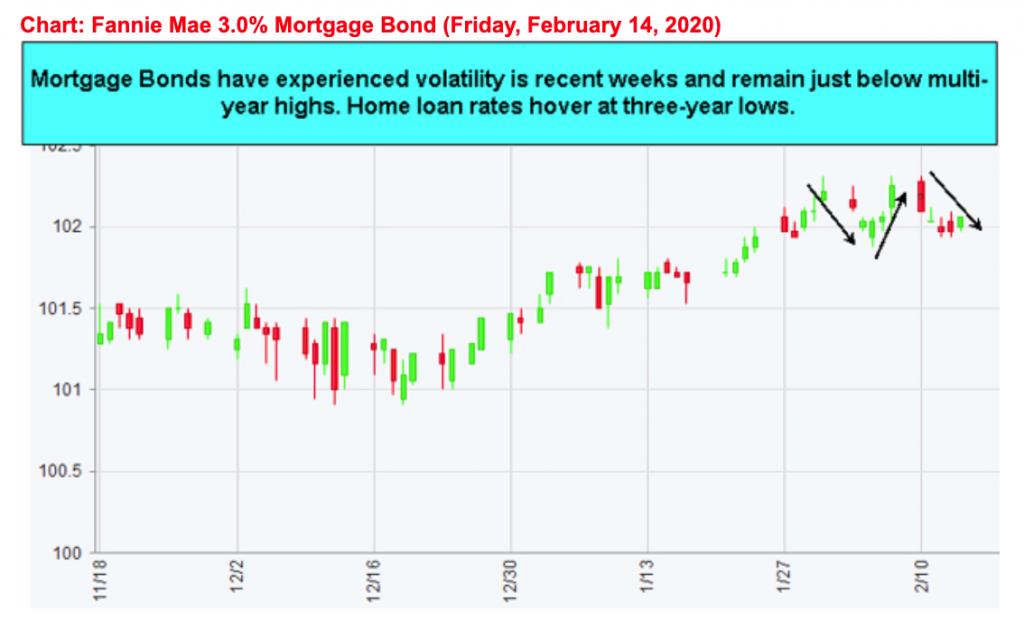

Home loan rates continue to hover right near three-year lows. There are many “smart” folks on Wall Street who say rates are going to push even lower at some point…and they may be right. But what if they’re wrong? What if rates have bottomed for the foreseeable future?

Home loan rates continue to hover right near three-year lows. There are many “smart” folks on Wall Street who say rates are going to push even lower at some point…and they may be right. But what if they’re wrong? What if rates have bottomed for the foreseeable future?

Yes, locking a home loan right here would be wise.

Here are three reasons why rates may have bottomed — at least for now:

- Solid economic numbers continue to be reported. We are seeing a historically strong labor market, rising wages, high consumer and business confidence, and an overall boost in housing. Bonds hate good news and there is simply too much good news to go around at the moment.

- Signs of improvement around the globe. One of the main tailwinds to our low rates is the relative underperformance of countries around the globe. It appears that many parts of the world are doing a bit better thanks to central bank monetary stimulus. If this trend continues, it’s tough to see much better rates anytime soon.

- The trading action in the Treasury market. This may be signaling that further rate improvement from here may be tough to achieve. In recent weeks, in the face of heightened fear and uncertainty surrounding the coronavirus (which usually lowers rates), the 10-year Note yield was unable to move beneath 1.50%, which is also close to a historically low yield seen just a few times in the last decade. If the 10-year Note can’t improve in the face of very uncertain news, a near-term bottom might be in place.

So, what would push rates to historically low levels? It would likely take some very bad news like an escalation of the coronavirus outbreak or possibly something worse.

Bottom line: the U.S. economy is performing very well. Rates are near historic lows and the markets are telling us this may be about as good as things get — for now. So, if you, your family, friends, or clients are considering a home loan, now is a terrific time to lock in at incredible rates.

If you or someone you know has questions about home loans, give me a call. I’d be happy to help.

Forecast for the Week:

Holiday-Shortened Week Focused on Housing Data

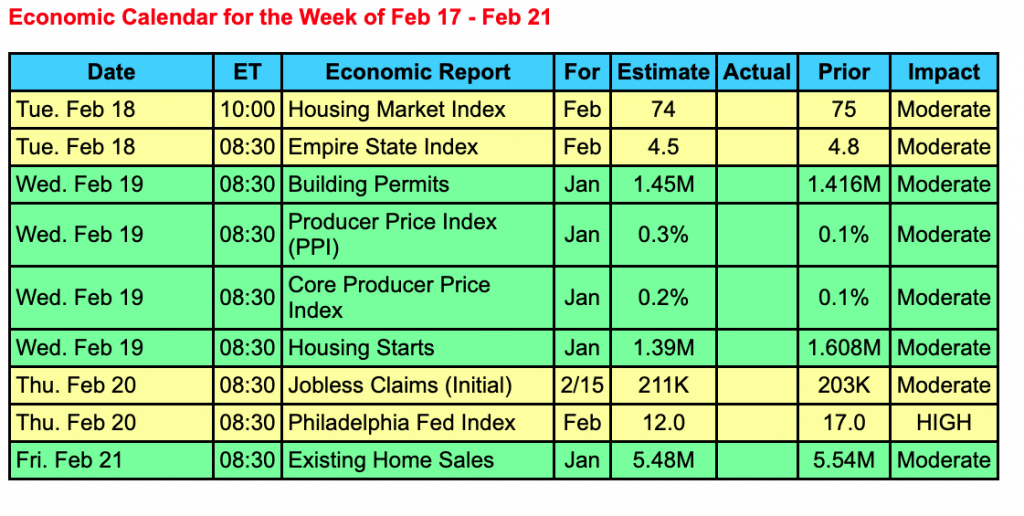

The upcoming week is holiday-shortened with the financial markets and most banks closed on Monday in observance of Presidents’ Day.

The week’s economic calendar is highlighted by housing data, which as mentioned, has gotten a boost by the strong labor market.

The markets will continue to be impacted by the coronavirus, which is a fast-moving story as it turns both positive and negative at a moment’s notice. Earnings season is winding down with 72% of S&P 500 companies reporting better than expected earnings in the latest quarter.

The minutes from the January Fed meeting will be released on Wednesday, but little impact is expected after Fed Chair Powell said last week that the U.S. economy “is in a good place.”

Reports to watch:

- Housing data dominates the economic calendar with the NAHB Housing Market Index on Tuesday, Housing Starts and Building Permits on Wednesday, and Existing Home Sales on Friday.

- The Producer Price Index will be delivered on Wednesday, and the Philadelphia Manufacturing Index and Weekly Claims on Thursday.

The Mortgage Market Guide View:

How to Stay Healthy During Flu Season

Flu season is upon us once again, and when you work with the public — constantly shaking hands, sharing office supplies and equipment, touching phones, keyboards, and doorknobs — it’s important to take care of yourself and do your best to avoid getting sick. Clients, co-workers, partners, children, their friends, and even your friends can all carry and share cold and flu germs. Fortunately, there is plenty you can do to reduce your flu risk.

First, and most importantly, wash your hands. Wash them frequently, before and after contact with others, or after using shared items. It’s important to scrub hard with a rich lather for at least 20 seconds and get the backs of your hands, between your fingers, and under your fingernails. If soap and water aren’t available, alcohol-based hand sanitizer can kill cold and flu germs.

Maintain a healthy lifestyle. Your immunity is affected by how well you take care of yourself when you’re healthy, so eating balanced, regular meals, getting adequate rest, and controlling your allergies are great ways to strengthen your body against viruses.

Safeguard your environment. It may sound like overkill, but surveilling your environment for items that could be contaminated, such as doorknobs, light switches, chairs, and other things that are shared — and wiping them down with sanitizing wipes — will significantly reduce your risk.

If you do happen to get sick, do everyone a favor and stay home from work. Also, avoid shaking hands and sneeze into a tissue instead of your hands. Take care of yourself, heal, and don’t pass it on.

Sources: UW Health, cdc.gov, WebMD

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors.As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you.Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose. Feature photo by Lora Ohanessian.

We are ready to help you find the best possible mortgage solution for your situation. Contact Sheila Siegel at Synergy Financial Group today.